Gross Annual Income In Quickbooks

And your accountant can provide financial expertise based on your statement. Add Your Business Expenses.

The Ultimate Quickbooks Guide For Entrepreneurs Arielle Gelosi Quickbooks Business Finance Management Small Business Bookkeeping

Income and expense spreadsheets can be useful tools to help you see where your personal or business finances stand.

Gross annual income in quickbooks. By knowing the gross income you can calculate the gross profit margin which is the percentage of revenue remaining after subtracting COGS. In the year 2020 the company earned a Gross. On the form regarding GSTHST and add the amount of GSTHST to your gross sales or fees to calculate your adjusted gross sales or adjusted professional fees.

Follow the instructions in part 3 of your form to find your total business income for each form T2125. It should be filed with form T1 for your annual personal income tax return. For example for future gross profit it is better to forecast COGS and revenue Revenue Revenue is the value of all sales of goods and services recognized by a company in a period.

Knowing this percentage gives you an idea of how much your COGS is taking away from your sales. How to Create a Formula for Income Expenses in Excel. After youve assembled.

Revenue also referred to as Sales or Income and subtract them from each other rather than to forecast future gross profit directly. Use the PL statement to summarize monthly quarterly or annual operations. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE.

The first part of the Income Statement reveals the Gross Profit earned by Microsoft from the years 2016 to 2020. Lets take the example of Microsofts Income Statement to understand how to read a standard Income Statement. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques.

Similar to calculating federal income taxes taxpayers have to make adjustments to their gross income to get to their adjusted gross income. Adjustments are made by taking certain tax deductions. For example if sales are 1 million and gross income is 400000 the gross profit margin would be 40.

You can also use the statement to measure profitability by calculating business. California has one of the highest state income tax rates in the country. Investors and lenders want to see your income statement to assess your businesss risk.

The information can show you where your money is going. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. Unlike gross sales gross receipts capture anything that is not related to the normal business activity of an entity tax refunds donations interest and dividend income and others.

Most sole proprietors. There are nine tax rates in California starting at 1 and going up to 123.

Browse Our Image Of Household Income Statement Template For Free Income Statement Template Statement Template Income Statement

Sample Quickbooks Contractor Company Income Statement Accounts Chart Of Accounts Accounting Quickbooks

How Do I Run A Month To Month Sales Revenues Comparison For 2018

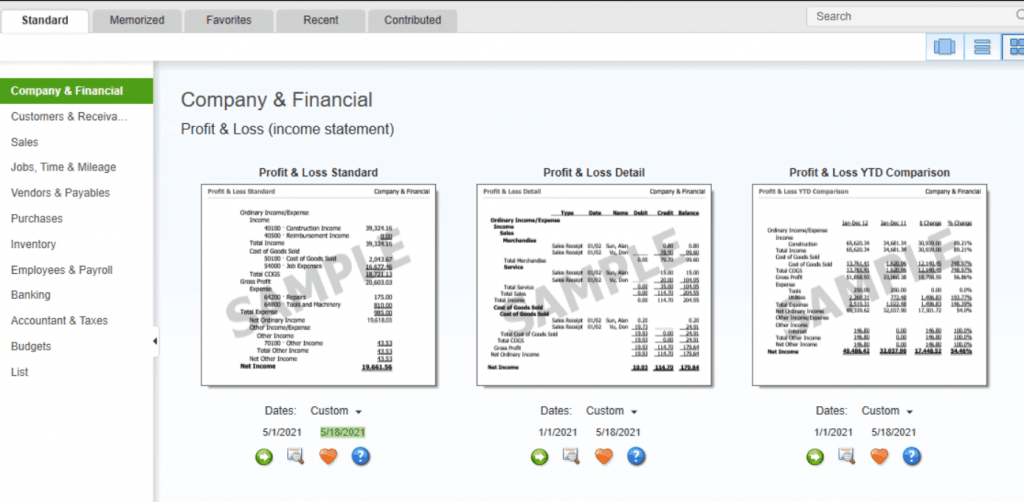

How To Create A Profit And Loss Report In Quickbooks Webucator

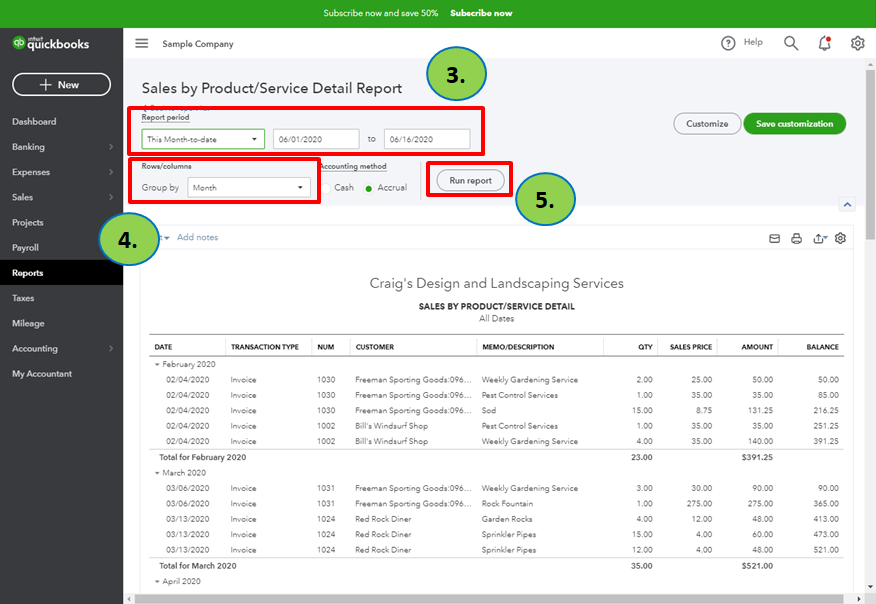

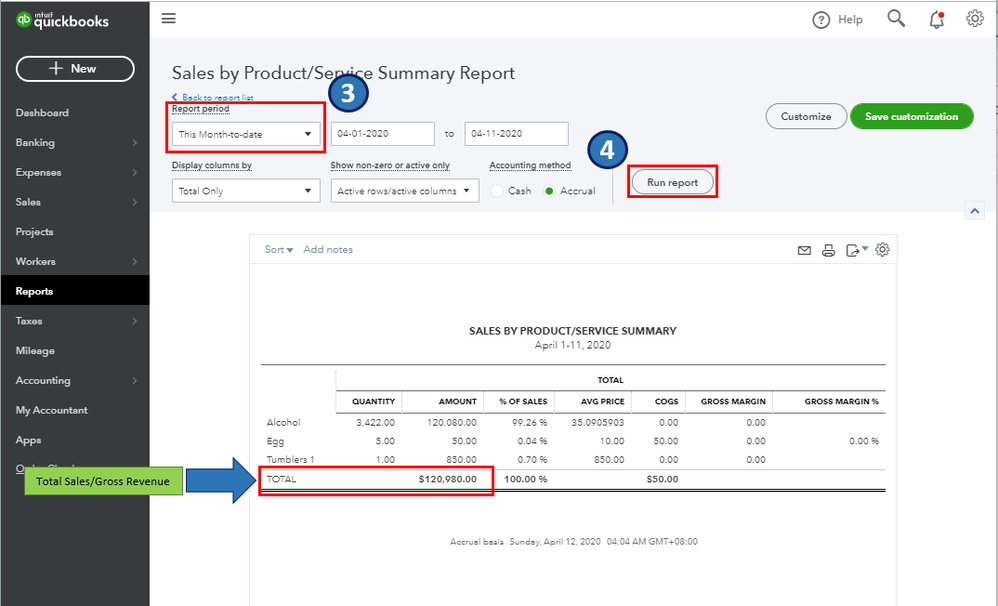

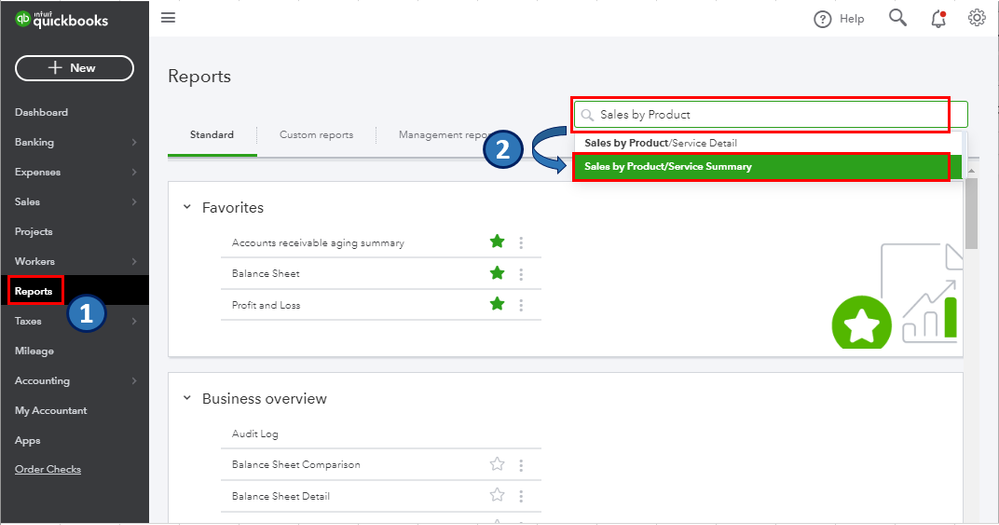

Can You Please Tell Me What Report Shows Gross Revenue Instead Of Gross Profit In Qb Online

Custom Quickbooks Revenue Report Youtube

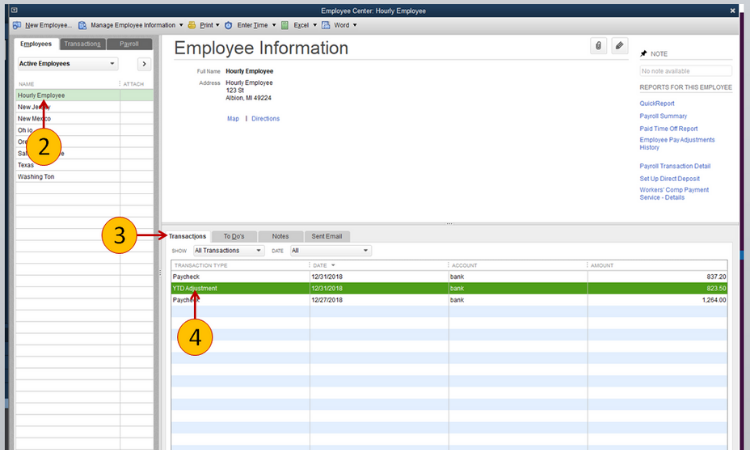

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

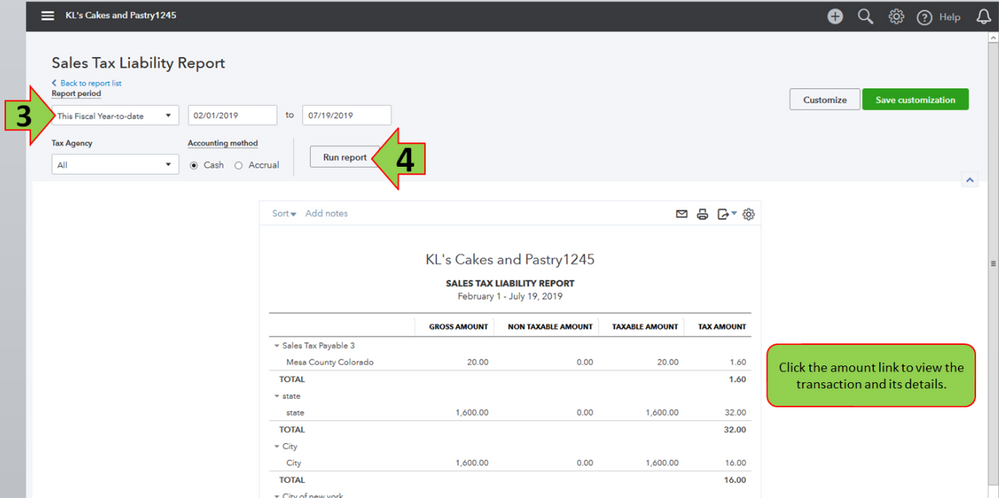

How To Create A Gross Revenue Report For Sales Tax Liability In Quickbooks Desktop Youtube

How To Adjust Ytd Payroll In Quickbooks Online

How Do I Find The Total Gross Sales In Order To Fill Our My Sales Tax Filing

Can You Please Tell Me What Report Shows Gross Revenue Instead Of Gross Profit In Qb Online

Using The Quickbooks App To Stay On Top Of Your Bookkeeping Small Business Finance Personal Finance Small Business Bookkeeping

Pin On How To Learn Quickbooks

How To Run Payroll Reports In Quickbooks In 3 Quick Steps

Illinois Income Tax Calculator Smartasset Federal Income Tax Capital Gains Tax Income Tax

How To Add Payroll Items To Multiple Employees In Quickbooks Payroll Quickbooks Quickbooks Payroll

Annual Filing Season Program Tax Prep Records Quickbooks

Post a Comment for "Gross Annual Income In Quickbooks"