Net Salary Calculator Malta

If the calculator for your country is missing let us to know and we will add the country there. Net Weekly Salary 58939.

Tax Calculator App For Iphone Ipad

The Malta Salary Calculator will help you calculate the net salary you will receive while working in Malta.

Net salary calculator malta. Salary Before Tax your total earnings before any taxes have been deducted. For example a financial controller might earn up to 88440 while a UXUI designer could expect to make up to 36610 and a project manager could bring in 144000. Calculating obligatory insurances and taxes.

Standard Maltese tax rates apply to those who have been residing in Malta. The average annual gross salary in Malta is around 18660 according to the National Statistics Office. The Konnekt Net Salary Calculator is a simple tool that gives you a comprehensive overview of your salary while employed in Malta.

You are paid in gross salary but you need to know what your budget is for paying for all costs of living. For this particular employees the minimum gross wage is 3 000 RON and special provisions are applied based on the Romanian legislation. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

This Malta Tax Net Salary Calculator is powered by KONNEKT recruitment agency. Salary calculator for computing net monthly and annual salary. You can calculate your salary on a daily weekly or monthly basis.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Spain affect your income. The Konnekt salary and tax calculator is a new simple tool that gives you a comprehensive overview of your salary while employed in Malta. KONNEKT Malta Tax Calculator allows users to calculate their net salary income tax and social security contributions by inputting their gross salary and any additional.

Tax rates for non-residents. This is the amount that gets paid in your bank by your employer every month. Net Annual Salary 2829070.

Average Salary Malta Average salary in Malta is 34510 EUR per year. Also known as Gross Income. At the higher end a CTO could earn around 240700 while the CEO of a company could.

The latest budget information from April 2021 is used to show you exactly what you need to know. This simple tool gives a clear breakdown of gross salary and deductions including tax Social Security contributions SSCNI government bonuses and most importantly the net salary you take home. However specialists can earn much more.

More information about tax rates for non residents can be found here. Konnekt Malta Tax Calculator allows users to calculate their net salary income tax and social security contributions by inputting their gross salary and any additional. It takes into account a number of non-personal factors such as the Maltese Tax Bracket Social Security SSCNI and other adjustments to give you a breakdown of your gross salary for different pay periods yearly monthly fortnightly and weekly.

The Malta Salary Tax Calculator Broadwing Employment Agency is offering a free tool to calculate your weekly monthly or yearly net salary based on the tax rates in Malta. We bring you the salary calculator for selected countries. You can calculate your Net salary by using a Malta salary calculator.

The most typical earning is 22235 EUR. Why not find your dream salary too. Net Monthly Salary 235756.

It takes into account a number of factors such as tax rates in Malta Social Security SSCNI contributions and government bonuses. Hourly rates weekly pay and bonuses are also catered for. Your monthly net pay will be 2853.

This will be partially refunded via tax rebate after this timeframe elapses. This payroll calculator for full-time employment does not apply to employees from the construction field. Individuals relocating to Malta will be subject to a higher tax band for the first 183 days.

The minimum gross salary. All data are based on 478 salary surveys. Youll then get a breakdown of your total tax liability and take-home pay.

Rates Of Pay Maltese Italian Chamber Of Commerce

Senegal Staff Report For The 2018 Article Iv Consultation And Seventh Review Under The Policy Support Instrument And Request For Modification Of Assessment Criteria Debt Sustainability Analysis Press Release Staff Report And Statement By

Why Are Salaries So Low In France And In The Uk Quora

Accounting And Finance Average Salaries In Malta 2021 The Complete Guide

Payroll Calculator Payroll Template Payroll Financial Budget

The Effects Of Economic Development On The Base Of A Sales Tax A Case Study Of Colombia In Imf Staff Papers Volume 1968 Issue 001 1968

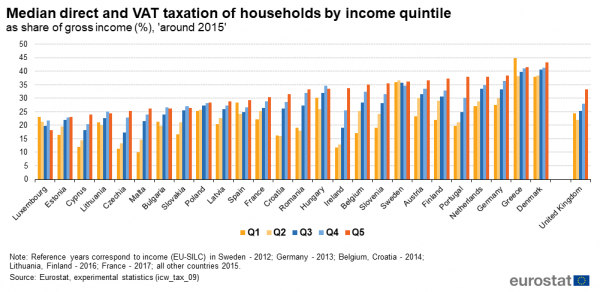

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

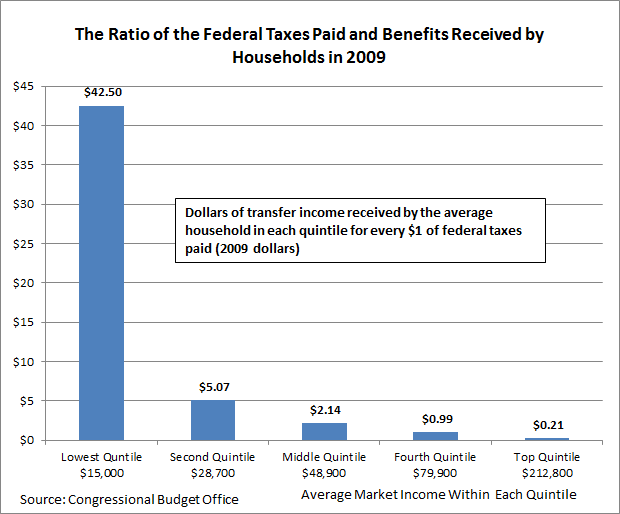

60 Percent Of Households Now Receive More In Transfer Income Than They Pay In Taxes Tax Foundation

Why Are Salaries So Low In France And In The Uk Quora

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Pie Chart

Why Are Salaries So Low In France And In The Uk Quora

Salary To Hourly Salary Converter Salary Finance Math Equations

Why Are Salaries So Low In France And In The Uk Quora

Senegal Staff Report For The 2018 Article Iv Consultation And Seventh Review Under The Policy Support Instrument And Request For Modification Of Assessment Criteria Debt Sustainability Analysis Press Release Staff Report And Statement By

Curba Injunghia Dute Sus Minimum Wage Per Hour Uk 2019 Taxex Justan Net

Why Are Salaries So Low In France And In The Uk Quora

Republic Of Madagascar Selected Issues In Imf Staff Country Reports Volume 2007 Issue 239 2007

5 The Imf S Income Model In Imf Financial Operations 2016

Post a Comment for "Net Salary Calculator Malta"