Salary Sacrifice Superannuation

This applies across all super accounts you may have not just VicSuper. However this calculator does not take into account the maximum contributions base.

Superannuation And Salary Sacrifice Two To Fire

From 1 January 2020 the law was amended to stop employers from offsetting an employees salary sacrificed superannuation guarantee.

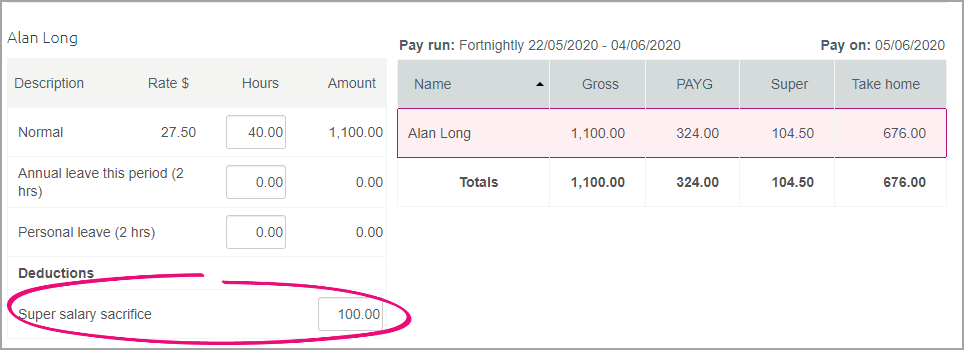

Salary sacrifice superannuation. Benefits can include goods and services like a car or laptop or contributions to your superannuation account. Salary sacrifice superannuation payments are typically also considered Reportable Employer Superannuation Contributions so may need to be accounted for as such in the Payment Summary Assistant. Salary Sacrifice in Australia Explained Superannuation.

Salary sacrificing to super Before-tax or concessional contributions are super contributions that come out of your before-tax pay. It forms a part of the Super concessional contribution cap the upper limit for which is 25000 per year including the employer contribution. AFSL 246383 Trustee the trustee of the EquipsuperSuperannuation Fund ABN 33 813 823 017 the Fund.

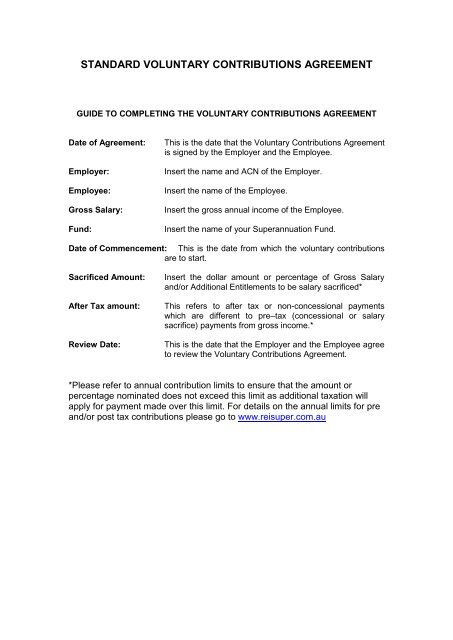

Superannuation Salary Sacrifice Form SUPERANNUATION SALARY SACRIFICE DEDUCTION AGREEMENT You should use this form if you would like to enter into an agreement to deduct part of your salary as a superannuation salary sacrifice on top of the standard 95 superannuation guarantee. Superannuation guarantee contributions are payable on salary or wages up to the maximum contributions base which is 58920 per quarter for the 202122 year. When you salary sacrifice into super your gross income may be reduced by that amount.

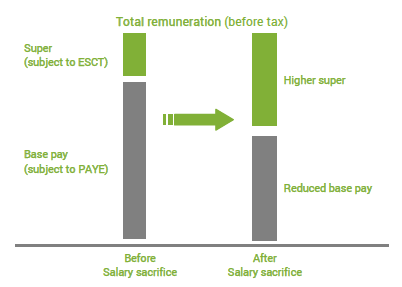

To sacrifice some of your salary into your super account you make an agreement with your employer for them to pay some of your salary straight into your super fund rather than into your bank account with the rest of your salary. Superannuation is a common benefit included as part of a salary sacrifice arrangement. A salary sacrifice arrangement is when you agree to receive less take-home income from your employer in return for benefits.

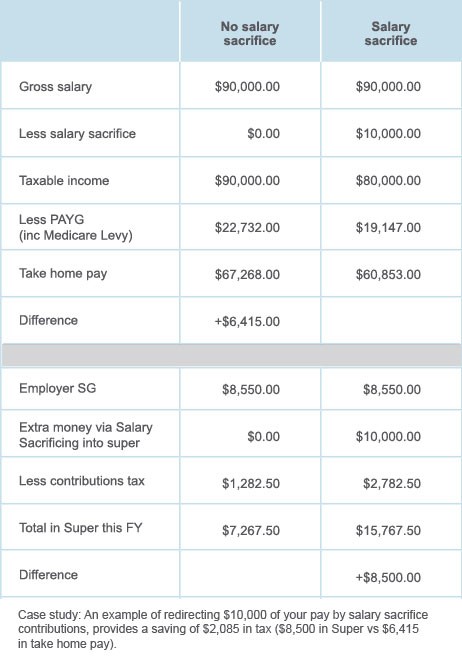

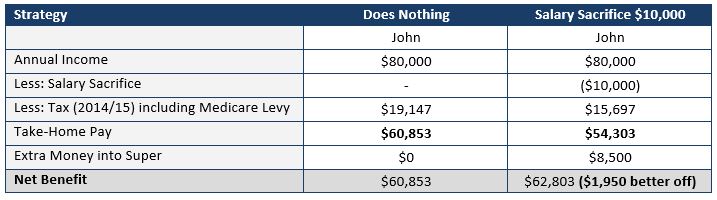

For your specific circumstances you should always seek clarification from the Australian Tax Office ATO or your accountant about how to handle salary sacrifice payments on your payment. Superannuation Salary sacrifice Salary sacrificing your employment income into superannuation may help to increase your retirement savings and may also reduce the amount of income tax you pay. So if youre earning 55000 per annum before tax and you sacrifice 5000 then your gross income for the purposes of calculating the 10 your employer must contribute is 50000.

This means the money going into your super account is from your pre-tax salary. Any amount within the concessional contribution cap is taxed at 15 and not at your marginal tax rate. How it works Salary sacrifice is an arrangement where you elect to receive part of your future salary as superannuation contributions instead of cash.

One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you. Opt for a salary sacrifice arrangement whereby your employer makes additional superannuation contributions beyond the compulsory superannuation guarantee SG amount from your pre-tax earnings and reduces your salary accordingly. This when done directly by the employer on behalf of the employee from his pre-tax salary is called Salary Sacrifice.

Or make a personal contribution and claim a tax deduction when you submit your tax return. Salary sacrificing which is also called salary packaging allows an employee to forgo some of their future entitlement to salary and wages in return for a benefit of a similar value such as superannuation contributions a car or other expenses. Salary sacrificing super Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value.

These benefits are paid out of your pre-tax salary. In the 201920 financial year you can add up to 25000 in before-tax contributions to your super account at the low tax rate of 15. Salary Sacrifice in Australia Explained Superannuation - YouTube.

Why salary sacrifice super. The amounts sacrificed into superannuation are taxed. Before-tax contributions include any superannuation guarantee contributions your employer makes and salary sacrifice or personal deductible contributions you make.

Issued by Togethr Trustees Pty Ltd ABN 64 006 964 049. By sacrificing some of your salary to your superannuation you can maximize your annual concessional super contribution limits as well as paying a lower rate of tax on the reduced wages. They include personal before-tax contributions you make via salary sacrifice Superannuation Guarantee contributions your employer pays for you and any after-tax personal contributions you make and claim a tax deduction for.

Salary Sacrifice Forrest Private Wealth

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

Salary Sacrificing Into Super Alturafinancial Com

Salary Sacrifice Form Template Fill Online Printable Fillable Blank Pdffiller

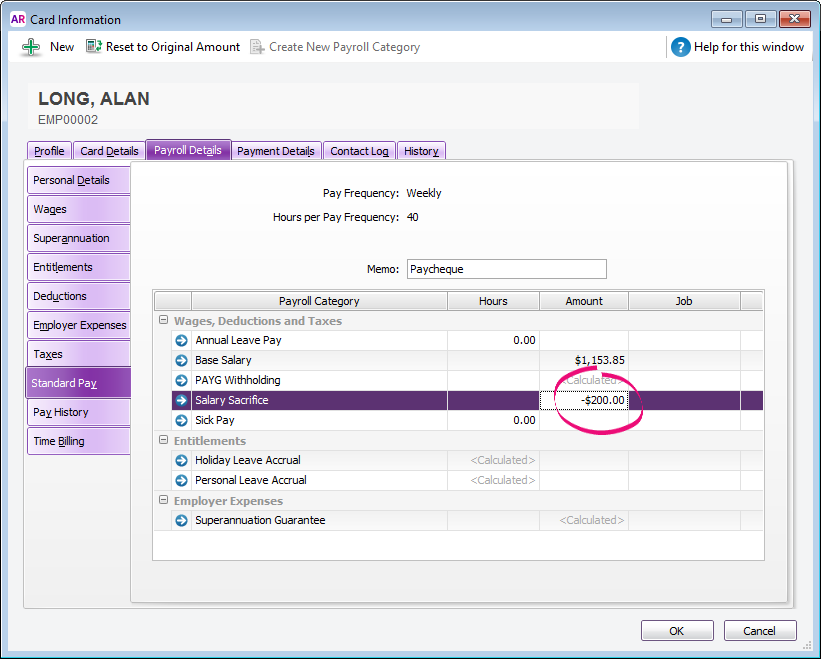

Setting Up Salary Sacrifice Superannuation Myob Essentials Accounting Myob Help Centre

Standard Salary Sacrifice Agreement Rei Super

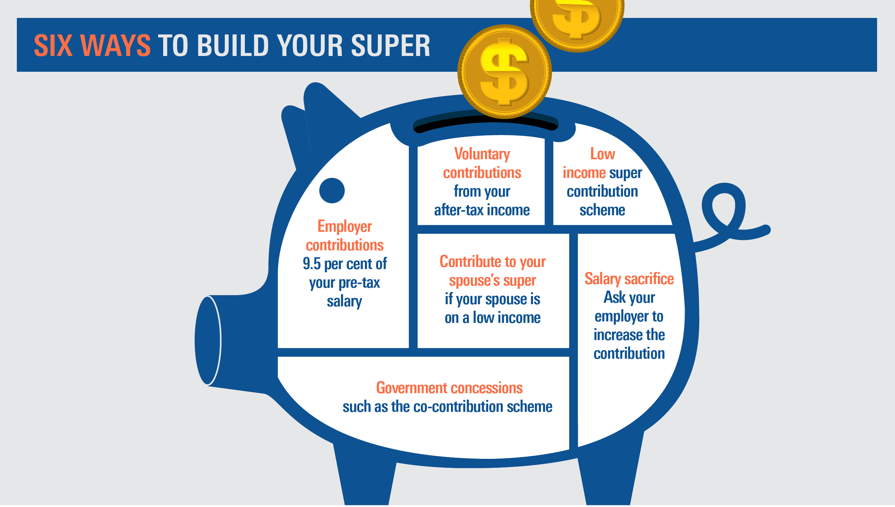

Building Your Super Intrust Super

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Https Www Adecco Com Au Media Adecco Au Client Payroll Adecco Group Superannuation Salary Sacrifice Agreement Weekly Pdf

Https Www Intuitbenefits Com Document 1313

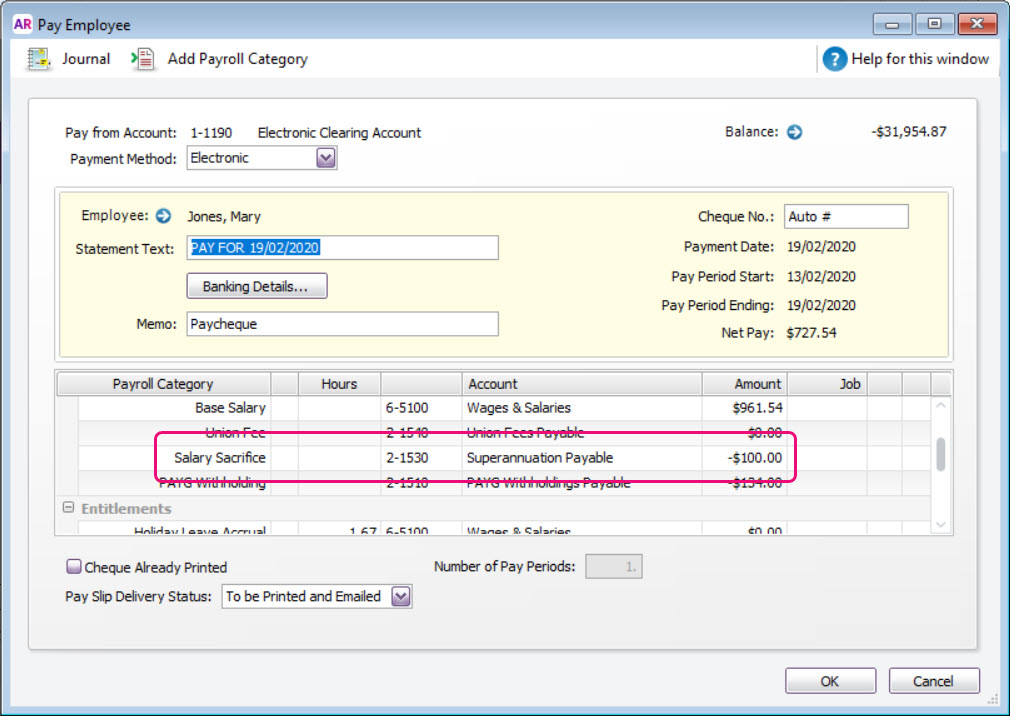

Solved Salary Sacrifice Into Super Gl Treatment Myob Community

Salary Sacrifice Arrangements Brentnalls Sa Accountants Advisory Services

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

What Is Salary Sacrifice And Is It Still Relevant Practical Systems Super

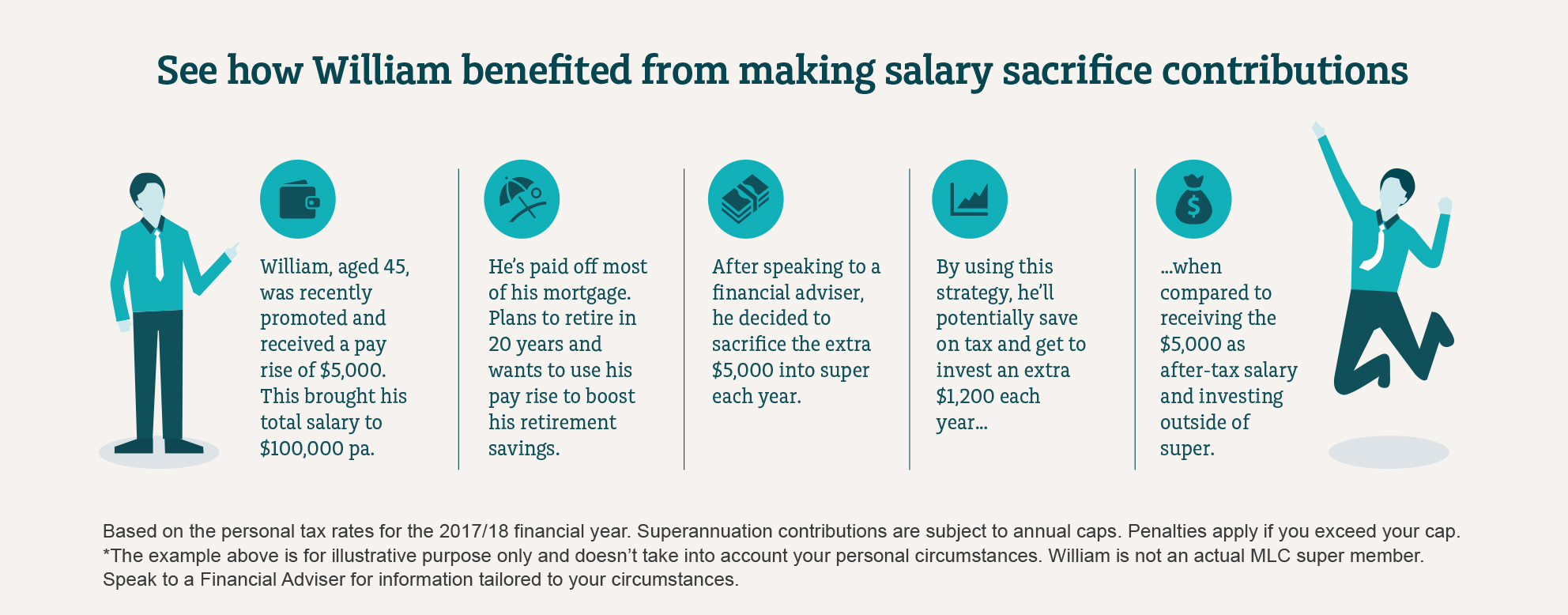

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

Salary Sacrifice Boost Your Super Mlc

Post a Comment for "Salary Sacrifice Superannuation"