Salary Sacrifice Options Australia

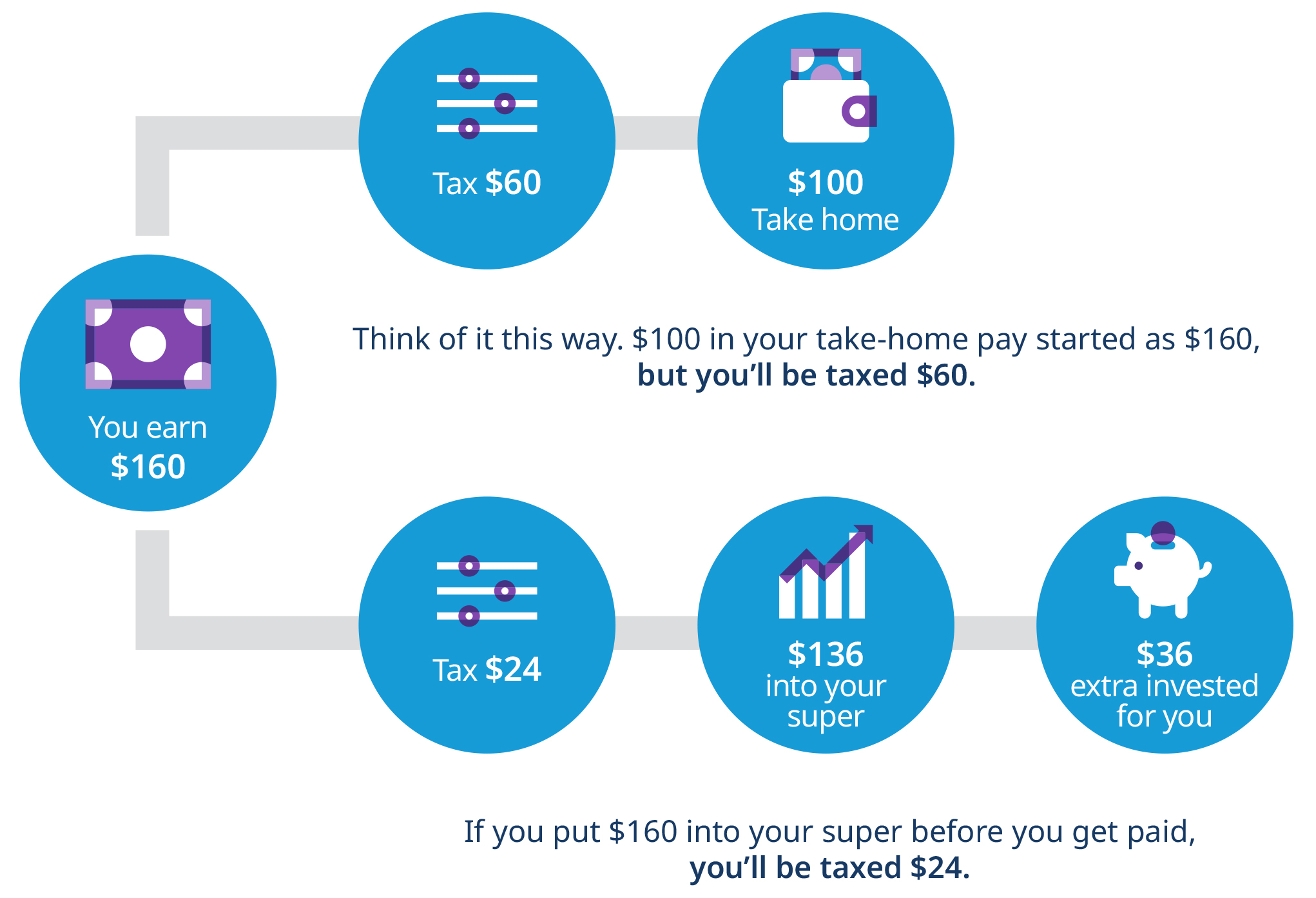

As salary sacrifice contributions come from your pre-tax salary you only pay 15 on them when they enter the super system if you earn less than 250000 or 30 if you earn over this amount. It is followed in United Kingdom and Australia.

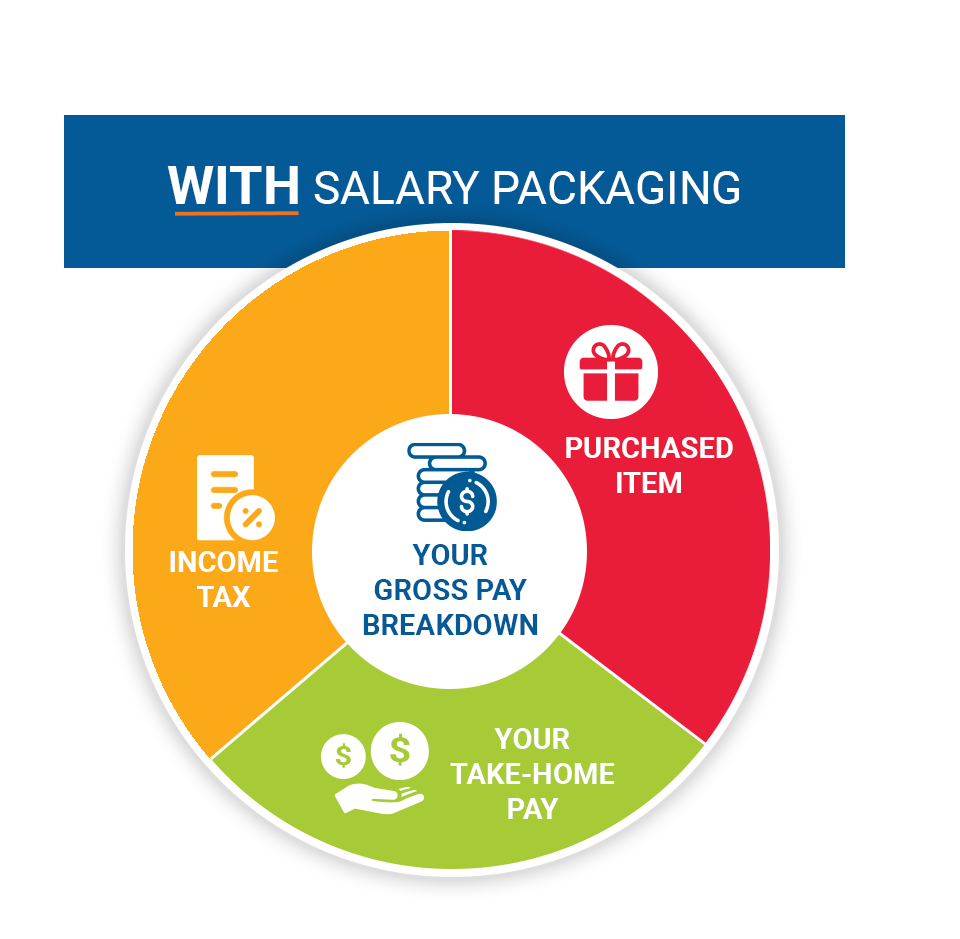

Salary sacrifice arrangements Under a salary sacrifice arrangement between the employer and their employee the employee agrees to forgo part of their future entitlement such as salary or wages in return for benefits of a similar value.

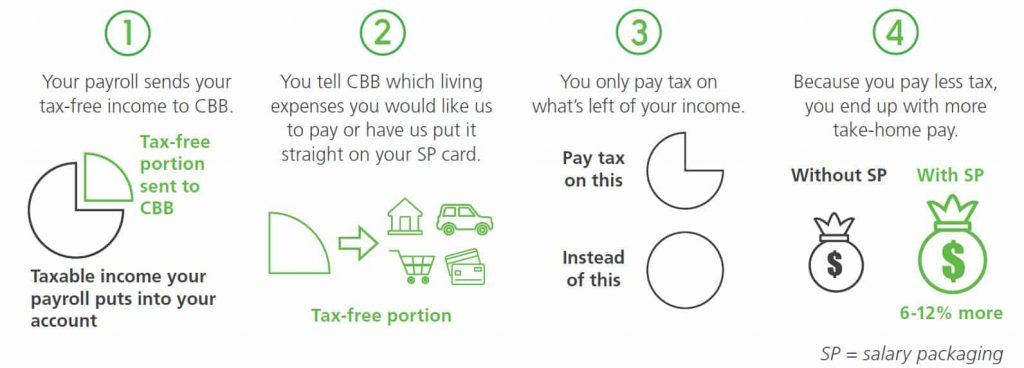

Salary sacrifice options australia. Salary packaging sometimes referred to as Salary Sacrificing is an Australian Tax Office ATO approved way of receiving benefits such as motor vehicles self-education expenses airport lounge membership and many more by way of a pre-tax deduction. A salary sacrifice arrangement is where you enter into an agreement with your employer to forego part of your future salary or wages in return for another benefit. Benefits of Salary Sacrifice.

Car parking fringe benefits. In CR201718 released today the Australian Taxation Office ATO accepts that fringe benefits arising from salary packaged FIFO travel costs are exempt under 477 for the arrangements administered by McMillian Shakespeare. It involves using your pre-tax salary to buy goods or services that youd normally buy with your after-tax pay.

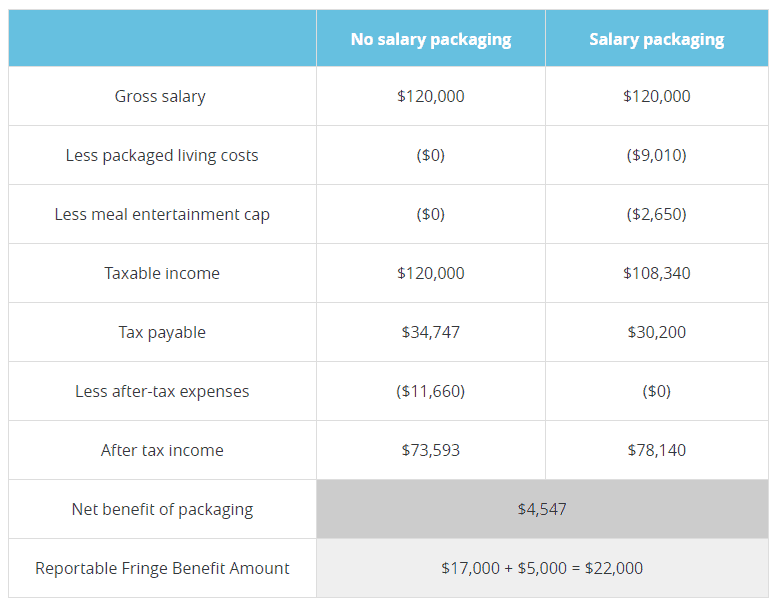

Salary sacrificing is basically a way to minimise your tax bill. The employee pays income tax on the reduced salary or wages. Maxxia - salary sacrifice and novated lease Super SA - member and employee portal Superannuation Products.

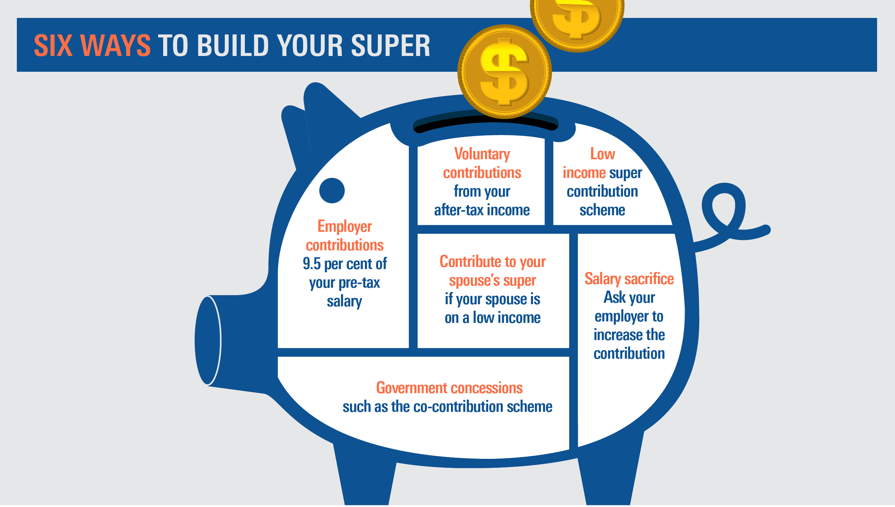

Salary sacrificing is sometimes called salary packaging or total remuneration packaging. Salary sacrifice arrangements come from your future before tax income. The minimum mandatory employer contribution to super is 95 of wages which is known as the super guarantee and that portion is taxed to the employee at only 15 much less than income tax rates.

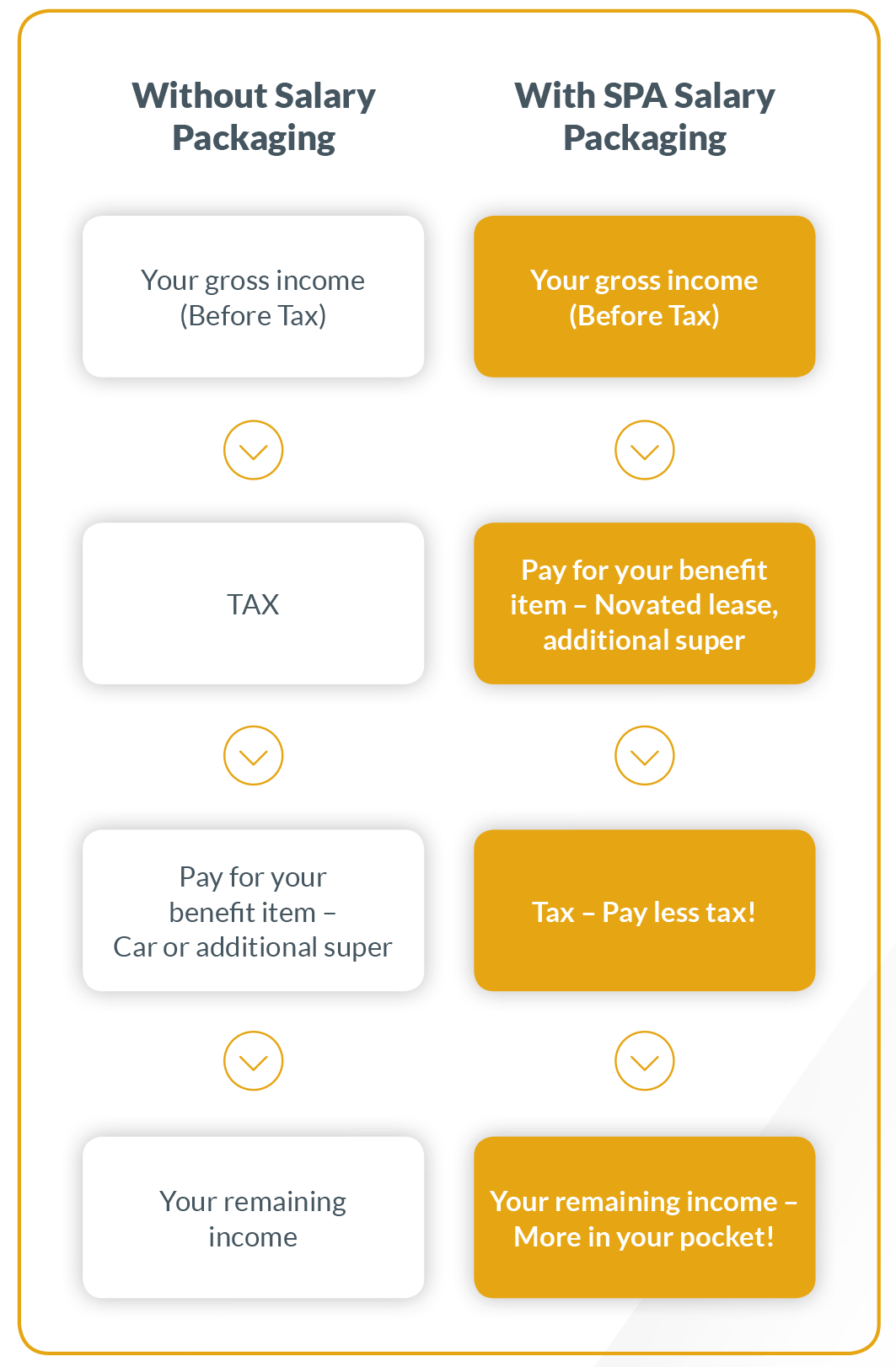

This can reduce your taxable income and increase your disposable income each pay period. The most common salary packaging items are. Benefits can include goods and services like a car or laptop or contributions to your.

This means they are taxed in the super fund under tax. The Government of South Australias salary sacrifice arrangements are coordinated by the Commissioner for Public Sector Employments office. The employer may be liable to pay fringe benefits tax FBT on the fringe benefits provided.

Salary Sacrifice Calculator is the pre-tax contribution one make from the take home salary to the super account which later helps in the retirement. Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value. These benefits are paid out of your pre-tax salary.

The two providers are. This is a lower tax rate than most employees pay on their income which can be as high as 47 with the Medicare levy in 202122 so these types of arrangements can be a good way to reduce your tax. Salary sacrifice is an arrangement whereby your employer pays for goods or services on your behalf out of your pre-tax salary.

The advantages of salary sacrifice are that you are buying the benefit in pre tax dollars. Salary sacrificed superannuation contributions are classified as employer super contributions not employee contributions. A salary sacrifice arrangement is when you agree to receive less take-home income from your employer in return for benefits.

Salary sacrificing your car If you have a car that you dont use for work you may very well consider salary sacrificing it. What Can I Salary Sacrifice. One of those arrangements is to salary sacrifice into superannuation.

The maximum amount is 5000 per employee but because this example uses 11 matching the maximum would be 2500 per employee. This pre tax income helps to reduce the pay tax by reducing the taxable income. In some cases you can save 1833 per year every year by doing this but it all depends on your specific circumstances.

Car fringe benefits ie. Otherwise deductible Living Away From Home Allowance fringe benefits. One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you.

Whilst the future prospect may be that employees relocate to and live in the remote areas in the. Under an effective salary sacrifice arrangement. Novated Lease Expense payment fringe benefits incl.

Any employee can salary sacrifice provided their employer is willing to offer the benefits. This calculator is used to find the. It is calculated by using two methods as a salary sacrifice contribution or as an after-tax contribution.

You pay for these benefits before you get taxed and then get taxed on your remaining income. Employees apply to join the SSSP and nominate the amount of salary to be sacrificed each pay period. Previously we have looked at the long term viability of FIFO arrangements.

The primary benefit used in salary sacrifice is the superannuation fund or super which is Australias pension program. Because in the eyes of the tax department youre earning less when youre salary sacrificing they tax you less. Salary sacrificing super.

That is if your tax. What income can I salary sacrifice.

Upgrade Your Future With Salary Sacrifice Mercer Financial Services

Https Www Lgsuper Com Au Assets Factsheets Salarysacrificedivd Pdf

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

Salarypackagingplus What Is Salary Packaging

Discover Salary Packaging Community Business Bureau

Login Default Option Binaire Rentabilite Donnees Personnelles

Salary Packing Opportunities For Not For Profit Employees Guided Investor

Salary Sacrifice Car The Definitive Guide 2021 Easi

How To Start Salary Sacrificing Gesb

.gif.aspx)

Salary Packaging And Strategy Bdo Australia

Building Your Super Intrust Super

Pin On Growth Mindset Quotes For Entrepreneurs

Financial Planning Is Not A Rubber Stamp Process Financial Start Up Business Financial Financial Planner

Salary Sacrifice Car The Definitive Guide 2021 Easi

Salary Packaging With Cbb Baptist Care Sa

What Is Salary Packaging Salary Packaging Australia

How To Create Multiple Streams Of Income 4 Ways Multiple Streams Of Income Earn More Money Business Growth Strategies

National Average Annual Salary Business Administration Operations Management Business Degree

Post a Comment for "Salary Sacrifice Options Australia"