Salary Sacrifice Or Net Pay

If you choose this option youll need to call us on 01293 586666 to set this up. In addition your employer will not have to pay their Employers National Insurance.

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

You can use salary sacrifice to increase contributions to your personal pension.

Salary sacrifice or net pay. As an employer you can set up a salary sacrifice. HMRC call it relief at. You give up some of your wages in exchange for extra contributions into your pension or other employer benefits.

The main advantage of salary sacrifice can be higher take home pay as youll be paying lower National Insurance contributions NICs. Only 15 tax is deducted from your salary sacrifice amount to super compared to the rate you pay on your income which can be up to 45 plus the Medicare levy. Employer pension contributions including pension contributions received in exchange for giving up an amount of pay under a salary sacrifice scheme you can still include pension contributions that the employee makes from their wages such as through a Net Pay Arrangement pension scheme amounts of pay given up under a salary sacrifice scheme.

However your employer may have rules around when you can do this for example if you have a relevant lifestyle event such as getting married. You should consider your marginal income tax rate when determining whether salary sacrifice is beneficial for you. A lower income could mean reduced benefits from your employer.

Do not pay NI on pension contributions. Once you sign up to salary sacrifice your overall pay is lower so you pay less tax and National Insurance. Hi - trying to understand better how much take home pay id have if I switch how I pay my current pension contributions to salary sacrifice.

The idea behind salary sacrifice is quite simple. You give up part of your salary and in return your employer gives you a non-cash benefit such as childcare vouchers or increased pension contributions. You might benefit from more pension contributions from your employer if they are giving you some or.

This salary sacrifice scheme is quite widely used by employers now because of the money it saves. Employees who enrolled in a car accommodation or school fee salary sacrifice agreement before 6 April 2017 are protected until the end of the agreement or 5 April 2022 whichever is soonest. You can also opt out of salary sacrifice at any time.

If the amount of your salary you choose to sacrifice brings you below a certain threshold you may lose a proportion of life cover your employer provides. Since April 2017 employees have been required to pay tax and National Insurance on salary they give up under any other salary sacrifice schemes or flexible benefit schemes. Pay National Insurance NI contributions on salary and bonuses.

Every time I have had a bonus have requested a reference letter for mortgage applications every pay rise and indeed the terms of my life insurance are all done on the. When an employee opts for a salary sacrifice scheme rather than a Net Pay Scheme they sacrifice part of their gross income for a corresponding pension contribution paid by the employer. More Net tax basis deducting contributions after tax Net tax basis is the default tax relief method with The Peoples Pension.

Salary sacrifice means you can exchange part of your salary in return for a non-cash benefit from your employer. Your employer will also pay lower NICs. It works less well once your income goes over the Upper Earnings Limit 42385 IN 201516.

Salary sacrifice reworks an employees remuneration in a more tax efficient manner at no additional cost to the employee or employer but can help generate higher pension contributions or higher take-home pay as a result. Salary sacrifice works like Net Pay but specifically means you have given up some salary in exchange for a higher pension contribution. Someone sacrificing salary will receive a lower level of taxable income but in return they will receive an employer contributionThe salary sacrifice arrangement wont change the individuals adjusted income figure unless the employer boosts the employer contribution by their NI saving.

I have been under a salary sacrifice scheme with three different employers for over 15 years and there has always been a clear difference between my payroll salary post-sacrifice and my gross salary pre-sacrifice. This means that if employees are contributing to a pension they will stop the contributions and the employer will pay. Net salary Whatever the legal ramifications may be any costs to be paid by the employee must be deducted from net pay.

Salary sacrifice is a formal agreed change to your contractual terms and conditions. Basic Pay 260833 monthly Pension 6260 think its 3 Other deductions 67140 Net Pay 187433 Ive been told that Ill save on national insurance and also get the company saving So you pay 3 of salary - 7825 You will now. Once you accept a salary sacrifice your immediate pay is lower and while this is a short-term sacrifice it can have multiple knock-on effect benefits.

You may see HMRC referring to this as the net pay arrangement method. Current setup is this. If for example the non-cash benefit is a pension contribution your employer would pay this along with a contribution they might make directly into your pension pot.

If you sacrifice some of your salary to make payments into your pension then you are also lowering your income. A salary sacrifice arrangement is an agreement to reduce an employees entitlement to cash pay usually in return for a non-cash benefit. It is not a salary sacrifice because the reimbursement has only been triggered by the employees resignation.

Salary sacrifice reduces your taxable income so you pay less income tax. You can normally change the amount you sacrifice increase or decrease the amount. So well automatically set you up on this arrangement when you sign up to The Peoples Pension.

60 Tax Relief On Pension Contributions Royal London For Advisers

Ray Lewis Net Worth 2020 Is 45 Million Us Dollar He Earns Through Her Football Career Source Of Income And Salary Nowadays In Millions Ray Lewis Lewis Ray

Tobey Maguire Lifestyle Wiki Net Worth Income Salary House Cars Favorites Affairs Awards Family Facts Bio Wonder Boys Film Producer Tv Commercials

Salary Sacrifice Forrest Private Wealth

Tobey Maguire Lifestyle Wiki Net Worth Income Salary House Cars Favorites Affairs Awards Family Facts Biography Awards Wonder Boys Film Producer

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

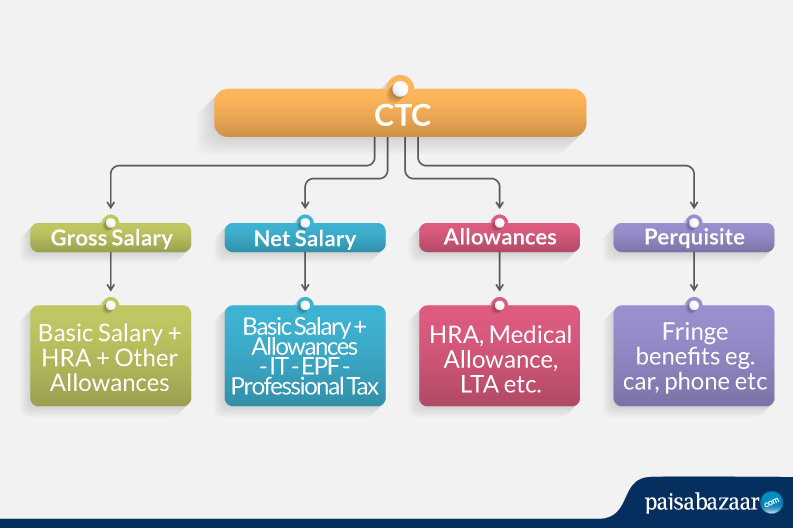

Salary Structure Components How To Calculate Take Home Salary

Millionaire Success Affiliation

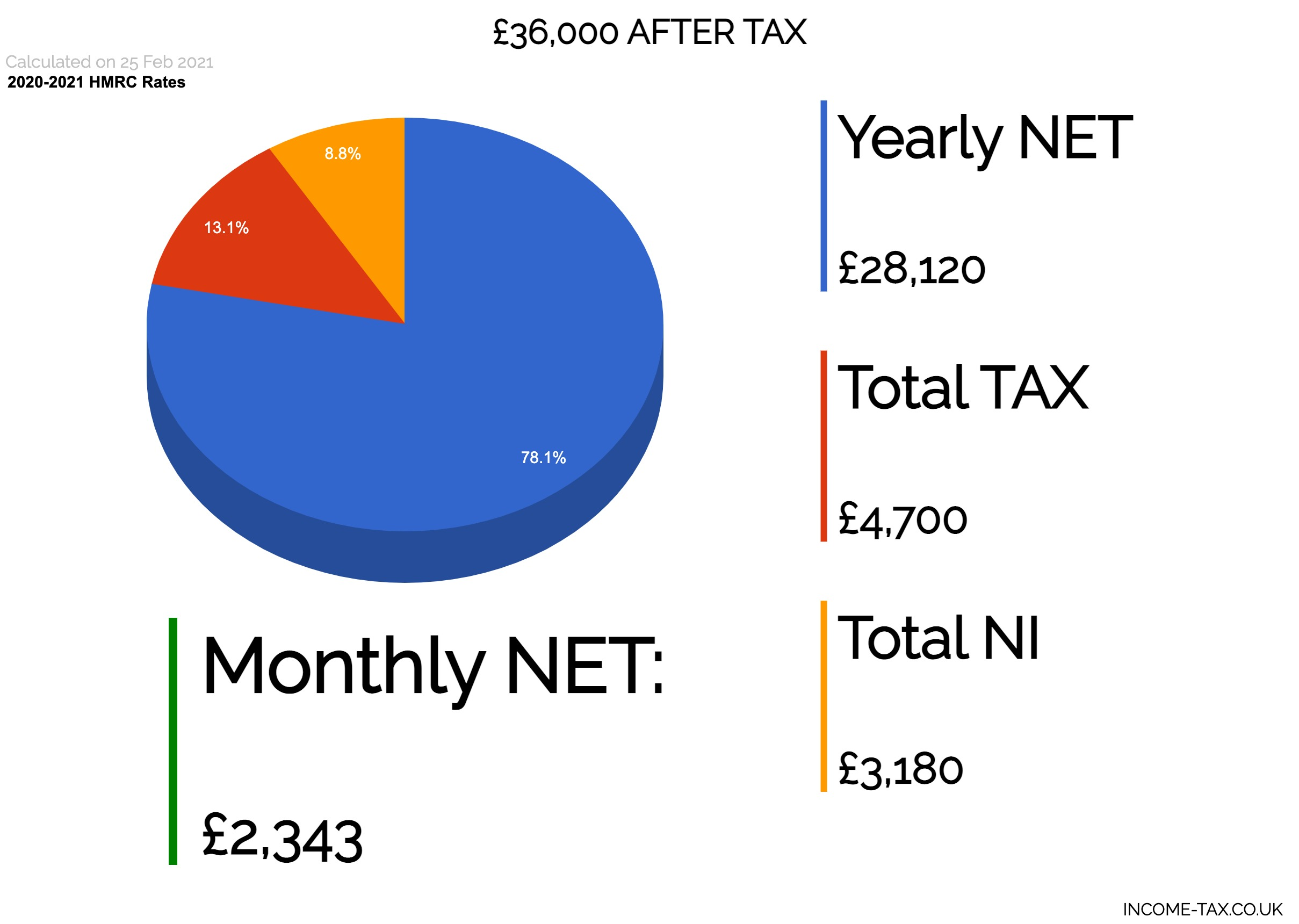

50 000 After Tax 2021 Income Tax Uk

It May Be Time To Review Your Salary Sacrifice Arrangements Jackson Toms

How Salary Sacrifice Works Youtube

Mexican Youtuber Yuya Net Worth As Well As She Is The Highly Paid Net Worth Of 921k Usd To 5 52m Usd Her Youtube Channel Bas Net Worth Beauty Vlogger Beauty

Know About Home Loan Loan Is The Process Of Giving Any Commodity Money Or Property To A Person In Exchange O Home Loans Home Renovation Loan Renovation Loans

Letter Template Best Template Collection Business Letter Template Letter Template Word Business Letter Format

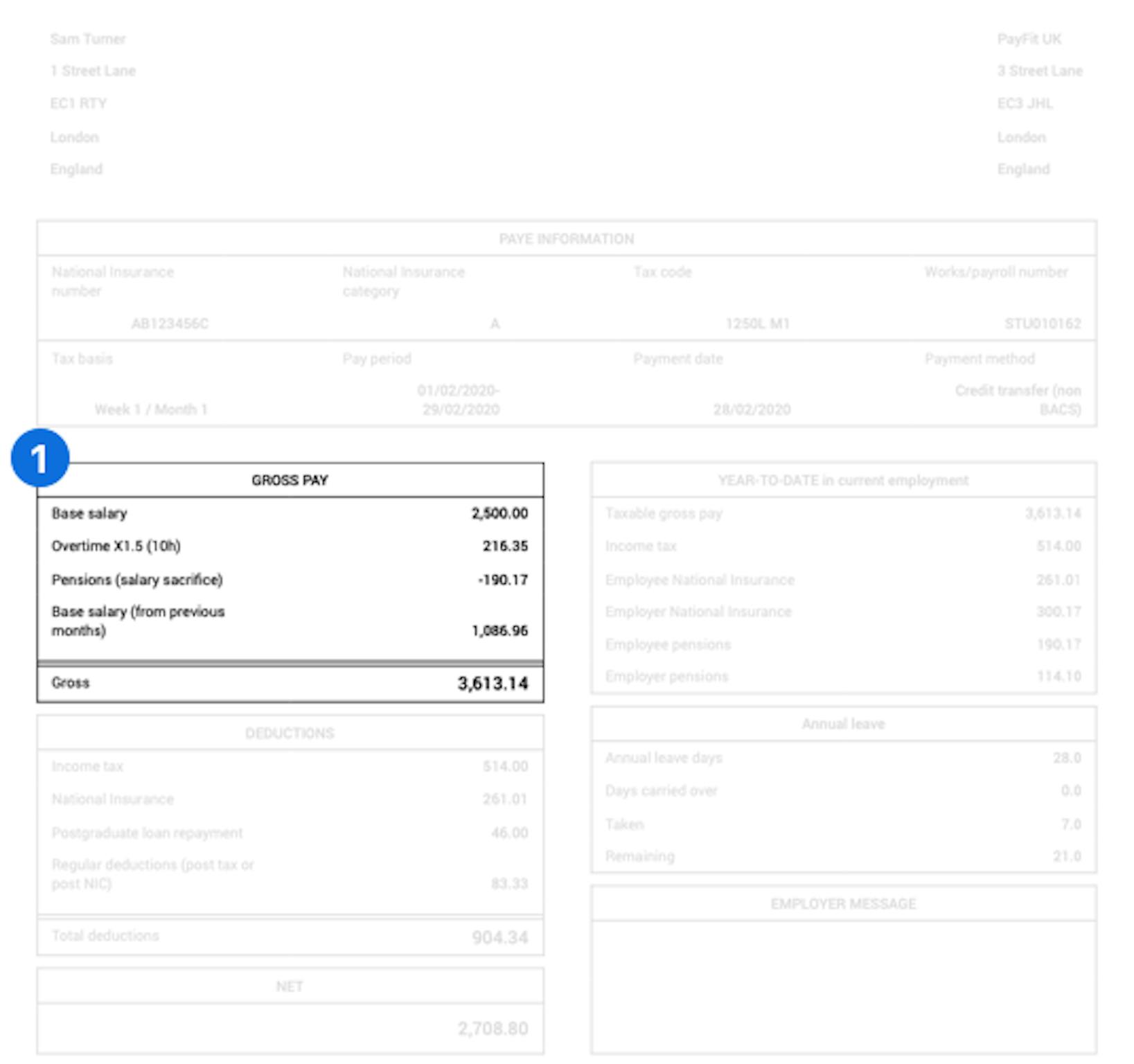

Understanding What S On Your Payslip

South African Dj Black Coffee Net Worth And Souce Of Earning Through Music As A Muscian He Listed In The Richest Dj S Of The World Dj Net Worth African Music

Marketing Job Descriptions Marketing Job Salaries Guide Salary Guide Marketing Job Executive Jobs

Post a Comment for "Salary Sacrifice Or Net Pay"