Salary Sacrifice Your Super

Salary sacrificing super Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value. Connect with a financial adviser As a QSuper member you can get advice about making extra contributions to your super over the phone at no additional cost.

Building Your Super Intrust Super

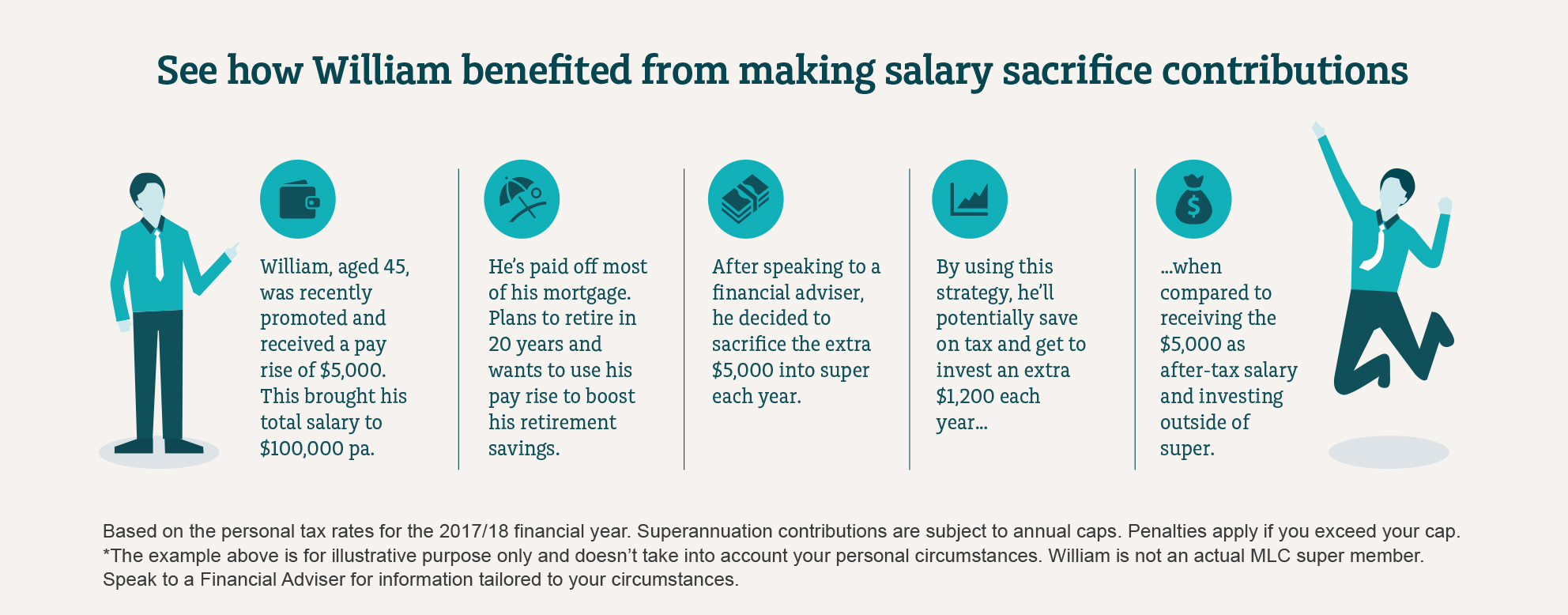

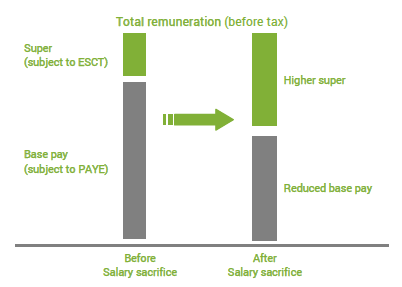

Salary sacrifice is an arrangement with your employer whereby you give up some of your salary in exchange for increased superannuation contributions.

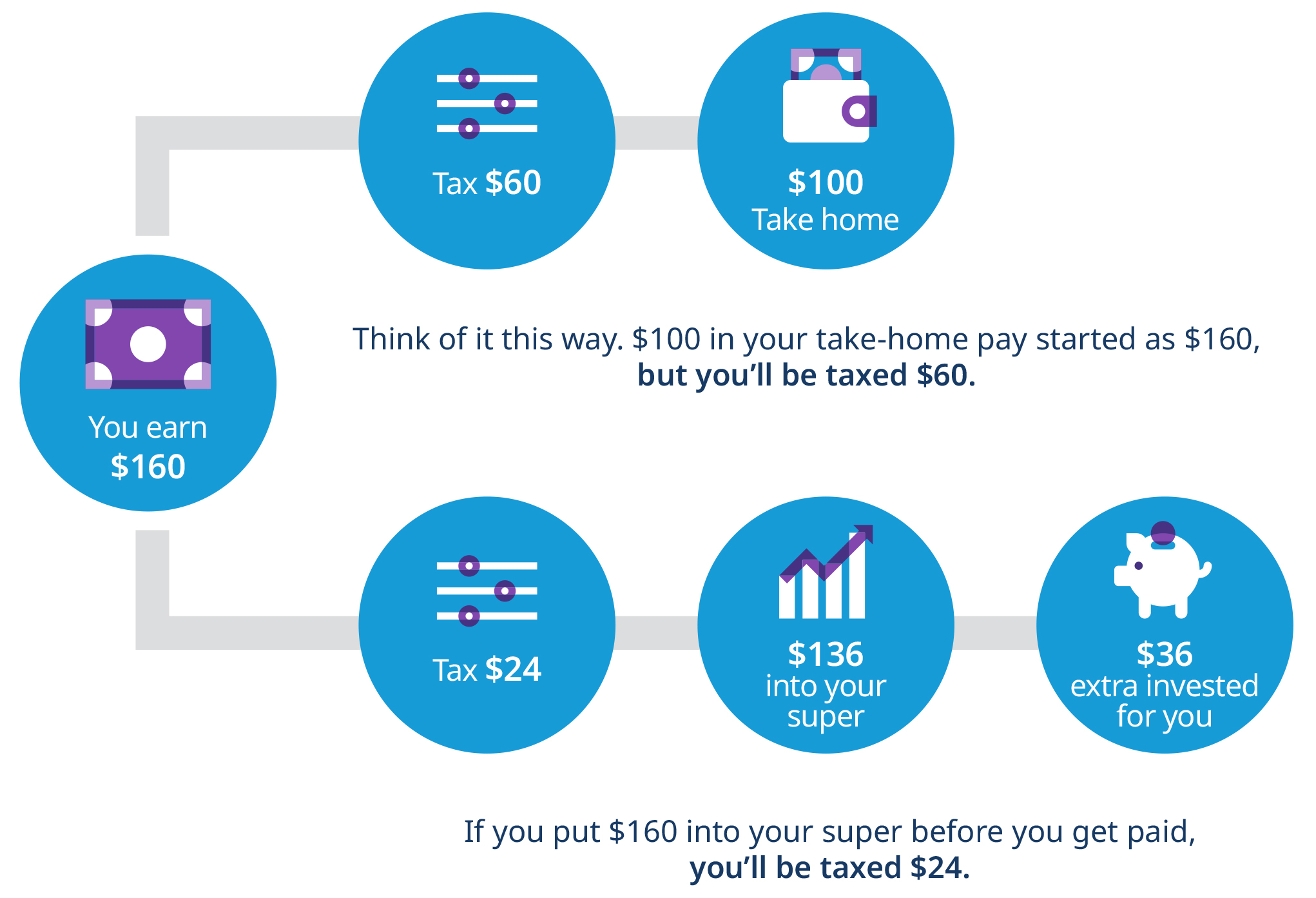

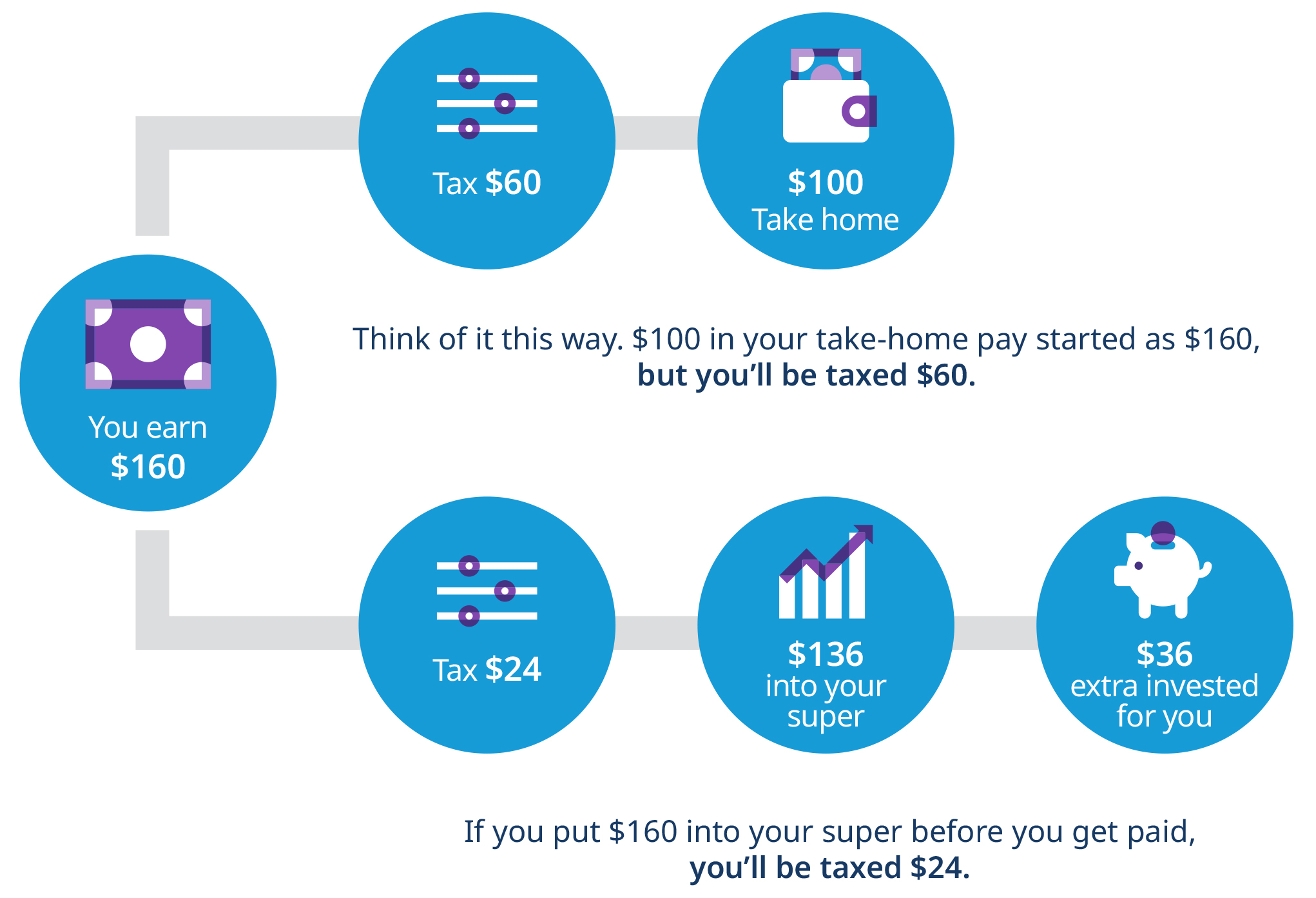

Salary sacrifice your super. In this video well look at how to setup and process a Superannuation salary sacrifice agreement in XeroWell also cover off a couple of common scenariosTO. Ensure you set up the salary sacrifice arrangement with your employer before you commence the work which usually means before the start of the financial year in which you plan to start salary sacrificing into your super. Thats because the money your employer takes out of your salary and puts into your super is taxed at 15.

By putting some of your pay into your super by salary sacrificing. Salary sacrifice contributions are included in the concessional before-tax contributions cap along with the super contributions your employer makes for you and after-tax contributions you claim a tax deduction for. AFSL 246383 Trustee the trustee of the EquipsuperSuperannuation Fund ABN 33 813 823 017 the Fund.

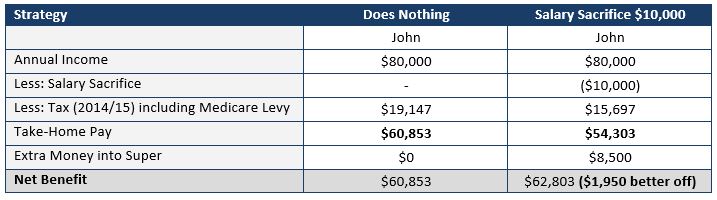

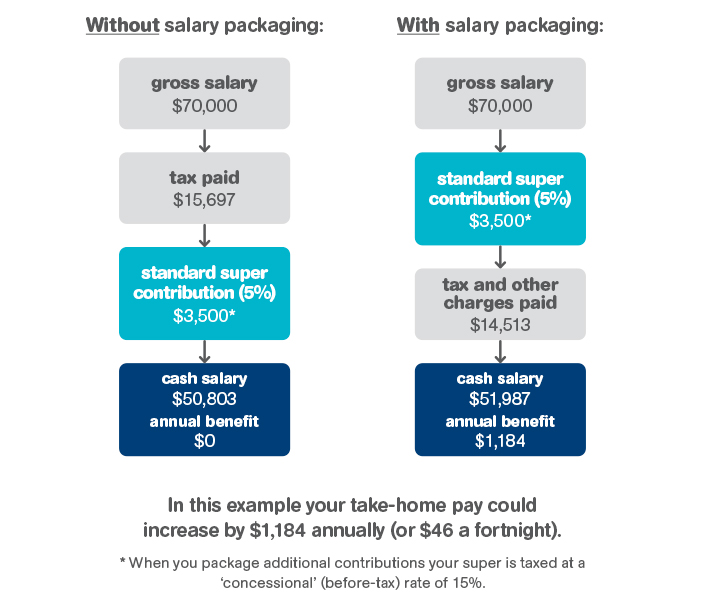

When you salary sacrifice you arrange with your employer to contribute an additional amount to your super out of your pre-tax pay. Can you salary sacrifice super to your spouse You cannot use your spouses unused concessional super cap to reduce your taxable income as the breadwinner of a household. Salary sacrificing is a method of diverting part of your salary into your super before you are charged any income tax.

Salary sacrificing is an easy way to give your super a boost and help it grow faster. Its when some of the salary youd normally receive as take-home pay goes into your super instead. Because it comes out of your salary before youve paid income tax its taxed as super at 15 and not your marginal tax rate.

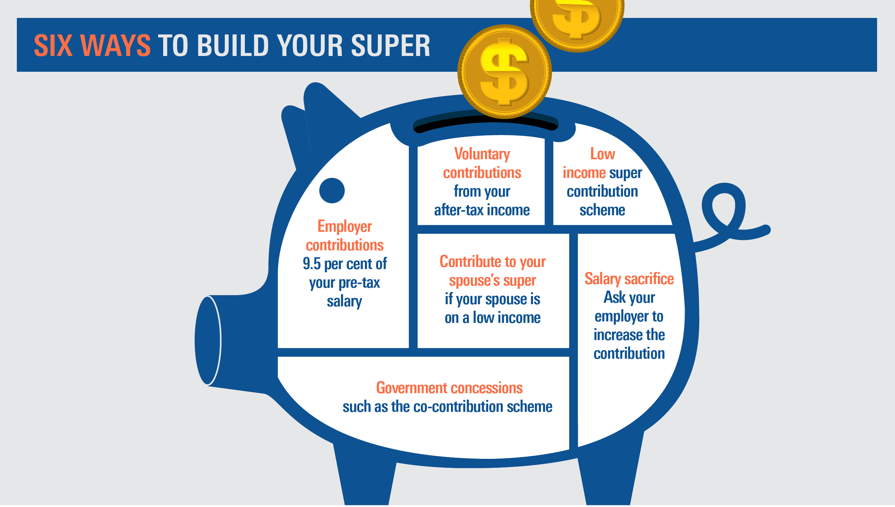

How to salary sacrifice into your super account. The amount you sacrifice from your pay is an extra amount into your super that is on top of your employers compulsory super contribution. Salary sacrifice The easiest way to make a concessional contribution is to ask your employer to pay some of your wage directly into your super.

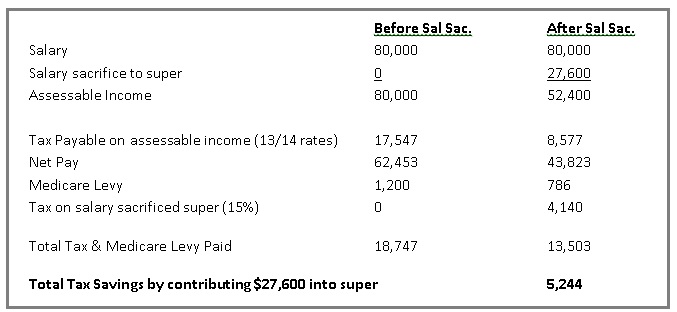

This cap is currently 27500 pa. This is on top of what your employer might pay you under the super guarantee which is no less than 10 of your earnings if youre eligible. Talk to your employer and find out if they offer these arrangements as not every organisation does.

Because its directed into your super before any income tax is withheld that money is taxed at the lower super tax rate of 15 instead of your standard income tax rate this could be as high as 45 depending on what you earn. From 1 July 2019 you can carry forward any unused portion of the concessional contributions cap for up to five previous financial years depending on your super balance. As employer contributions you dont pay income tax on these amounts although.

If your income including super is above 250000 pa youll pay 30 tax on your contributions. Under a superannuation salary sacrifice arrangement your employer can make additional super contributions when you arrange for some of your pre-tax salary to be paid into your super fund. One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you.

Your employer is already required to make standard superannuation guarantee contributions into your account. You should consider your debt levels before adding to your super. Salary sacrificing is the process of directing some of your pre-tax income into your super instead of your bank account.

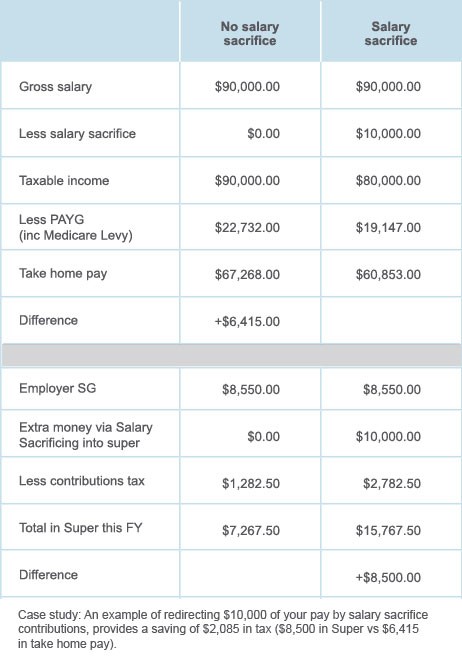

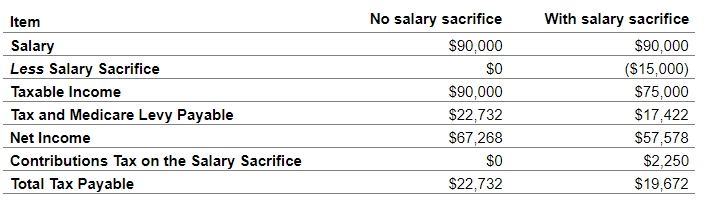

Salary sacrifice could also reduce your income for tax purposes meaning youll pay less tax. Your salary for tax purposes is then reduced while the additional contributions are treated as employer contributions. You arrange this with your employer.

You can however split your contributions with your spouse which provides no immediate tax benefit but does result in more equal balances that could be advantageous down the track. Salary sacrificing into super is where you choose to have some of your before-tax income paid into your super account by your employer. Salary sacrifice calculator This calculator can help you work out whether making before-tax salary sacrifice or after-tax contributions will give your super a bigger boost.

Issued by Togethr Trustees Pty Ltd ABN 64 006 964 049. Compare that to the marginal tax rate which can be anything up to 47 including the Medicare levy depending on how much you earn.

Salary Sacrifice Boost Your Super Mlc

Content Mercer Super Trust Australia

Salary Sacrificing Into Super Alturafinancial Com

Building Your Super Intrust Super

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

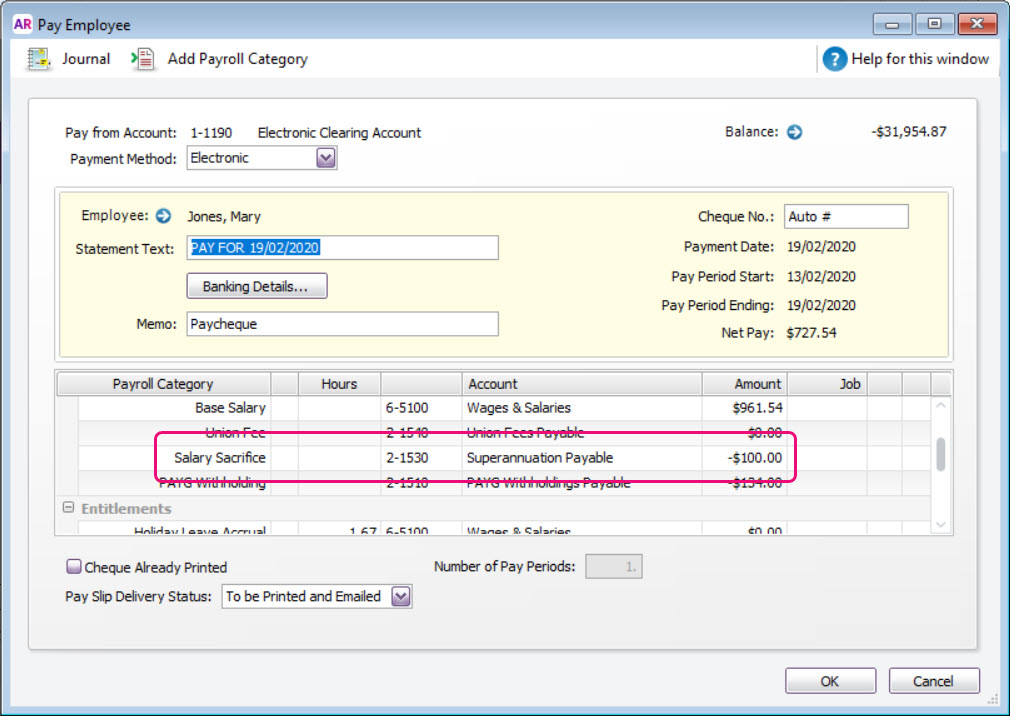

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Https Www Intuitbenefits Com Document 1313

Salary Sacrifice Alphington Private Wealth

Salary Sacrificing To Super Mc Ewen Investment

Salary Sacrifice Forrest Private Wealth

Super Salary Sacrificing Highview Accounting Financial

Upgrade Your Future With Salary Sacrifice Mercer Financial Services

What Is Salary Sacrifice And Is It Still Relevant Practical Systems Super

Superannuation Salary Packaging Remserv

Post a Comment for "Salary Sacrifice Your Super"