Salary Sacrifice Pension Example

How exactly does salary sacrifice boost your pension pot. Why use salary sacrifice.

Everything You Need To Know About Salary Sacrifice Banker On Fire

Jane has a salary of 35000 a year and contributes 5 into her pension while her employer contributes 3.

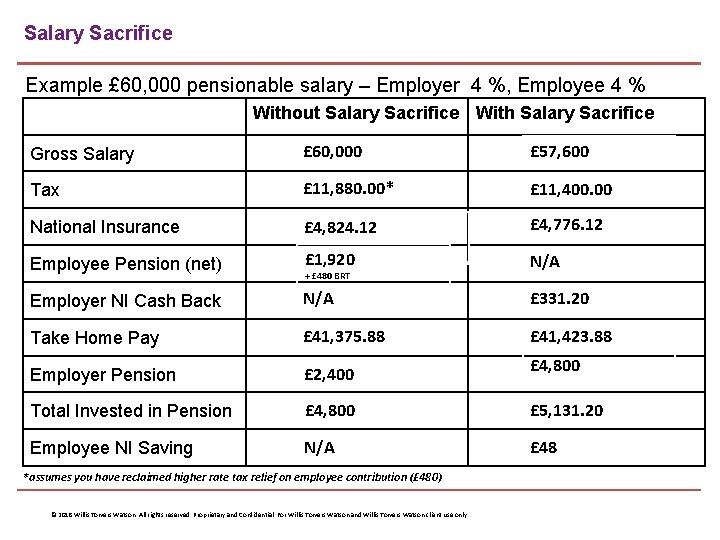

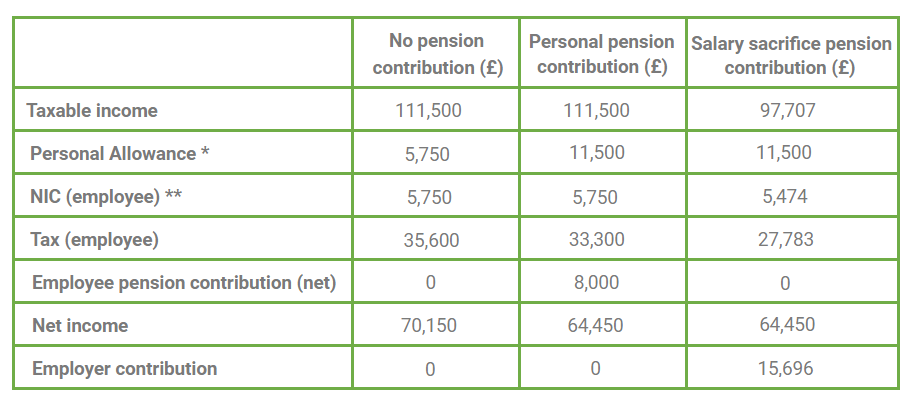

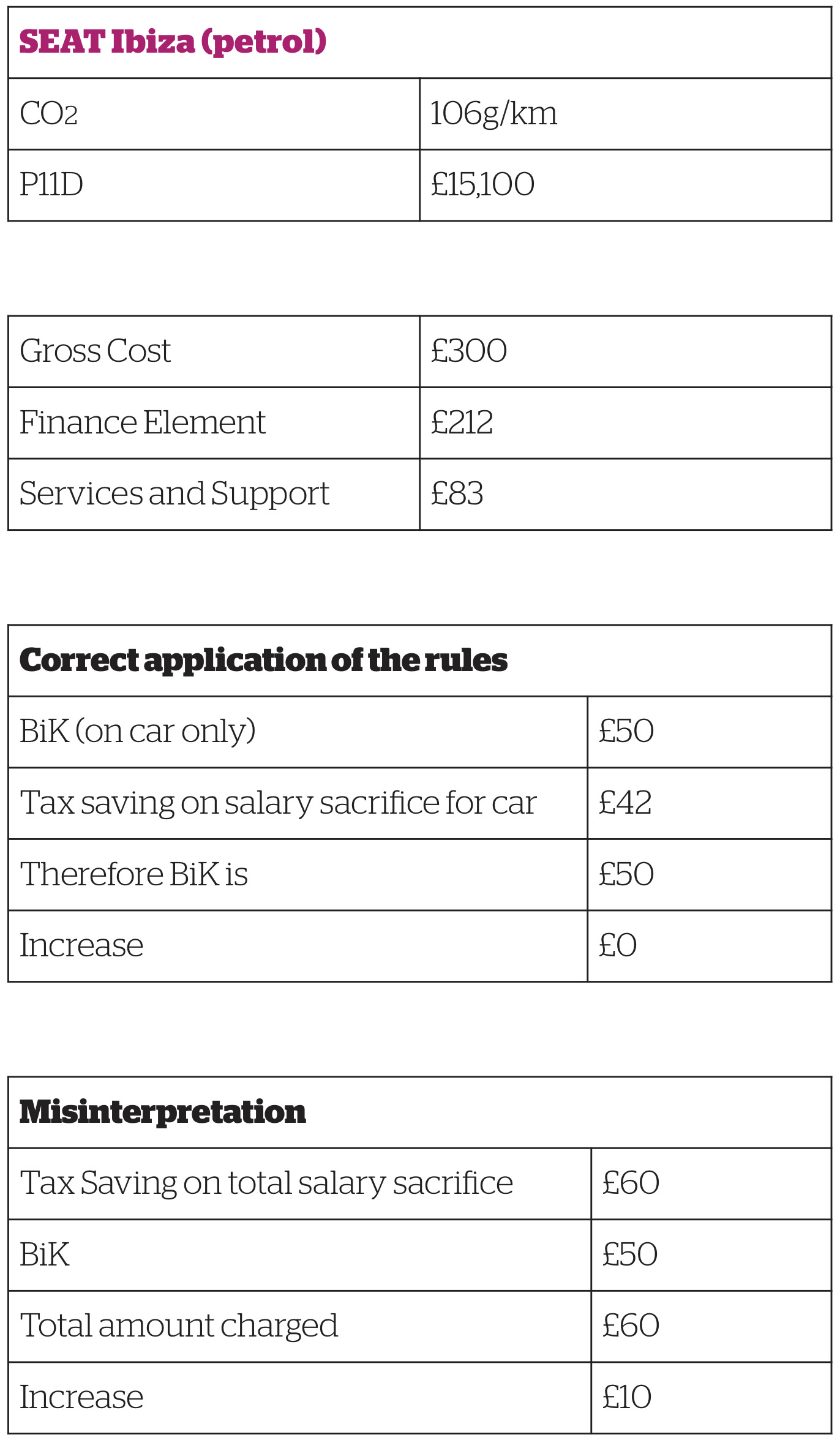

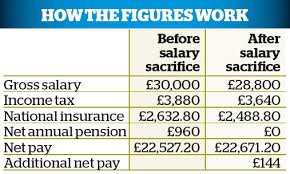

Salary sacrifice pension example. Under their revised contract the employee gives up some of their salary or contractual bonus in return for a non-cash benefit from the employer - for example an employer pension contribution. Before deciding to go ahead with the salary sacrifice scheme you are advised to consider the impact that this change in your remuneration might have on any other benefits or schemes that you are part of. You will save 138 of the amount sacrificed in NICs while your employees will save between 2 and 12 of the amount they sacrifice depending upon their earnings.

X of any NIC savings made as a result of this salary sacrifice scheme. A business in the UK with 200 employees on average earnings of 30420 could save around 40000 every year by using salary sacrifice for their workplace pension. There are two ways in which you can do this simple salary sacrifice and SMART Save more and reduce tax.

Salary or bonus sacrifice sometimes also referred to as salary exchange involves an employee agreeing to change their terms and conditions of employment relating to pay. This is a way to make your pension saving more tax-efficient and could mean your take home pay increases. A Salary sacrifice pension allows you to use the money you save on National Insurance Contributions and income tax to top up your pension and increase its value over time.

In particular you might want to consider the impact on any insurance. For any earnings above the upper earnings limit 43000 for tax year 201617 your NIC saving will be 2. The benefit must be provided by you.

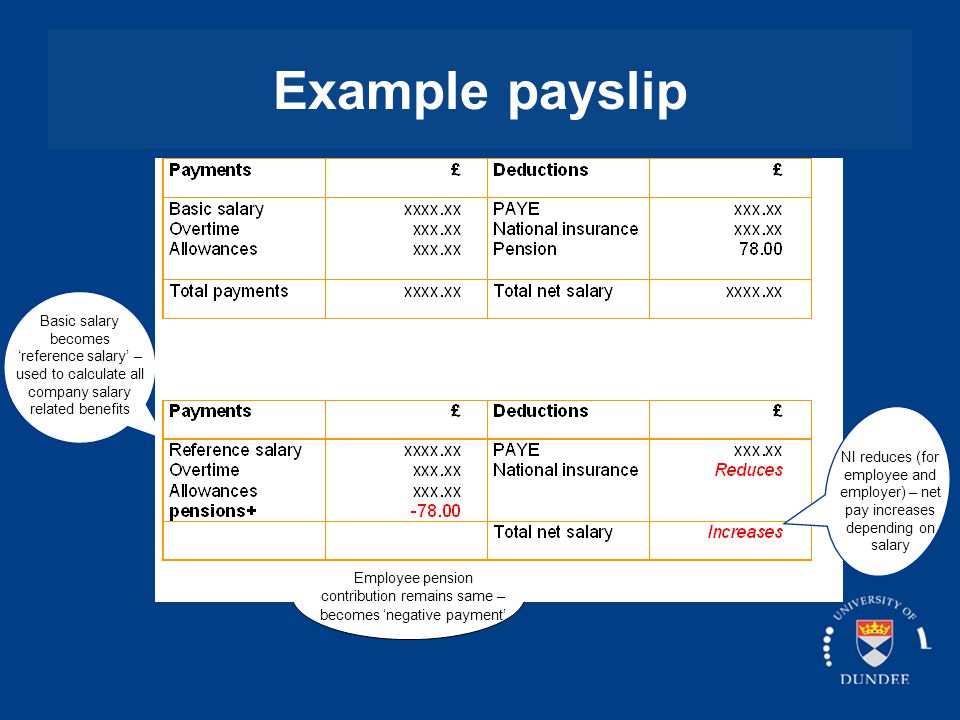

The Company will contribute to your pension scheme optional. What is salary sacrifice. An example of a salary sacrifice is where your.

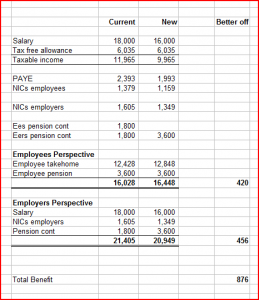

Salary sacrifice is being used to increase the pension contributions while maintaining the same take-home pay. Basic rate tax payer Non salary sacrifice Salary sacrifice. Salary sacrifice is where your employee agrees to give up some of their pay in exchange for a benefit.

With this system you can make the same. You can also choose to use the savings generated by salary sacrifice to increase your pension contribution which would mean that your take home income would be the same. You can save NIC of 12 of the amount sacrificed on earnings above the primary threshold 8060 for tax year 201617.

The company operates a salary sacrifice scheme to assist with pension contributions. Salary sacrifice means you can exchange part of your salary in return for a non-cash benefit from your employer. That means Jane is contributing 1750 and her employer is contributing 1050 for a total contribution of 2800.

And use salary sacrifice to boost their take-home pay to 19166. Because of the savings you can make pension contributions made in this way are more tax efficient than the personal contributions youd ordinarily pay into your pension. Or salary sacrifice can be used to boost your pension savings while leaving your net spending income unchanged.

If for example the non-cash benefit is a pension contribution your employer would pay this along with a contribution they might make directly into your pension pot. Under this scheme you agree to sacrifice part of your salary in return for a contribution to a pension scheme by the Company on your behalf equivalent in value to the amount of salary you have chosen to sacrifice. This is just an example calculation and how much you save will depend on by how much you choose to reduce your monthly pay.

This is a way to make your pension saving more tax-efficient and could mean your take home pay increases. Lets assume the employee is a 25 year old basic rate taxpayer living in England and earning 24000 a year. You and your employees can both make a saving in national insurance contributions NICs.

Salary sacrifice can be useful in the following ways. Not only would the business save money but the pension scheme members could also see an increase in their take home pay or benefit from higher pension contributions. This is what happens during the process.

Your employer might offer you the option of salary sacrifice as part of their pension scheme. Salary sacrifice pension example On a salary of 25000 20000 after tax suppose you currently put 5 or 1250 1000 250 tax relief at 20 into your pension each year and your employer contributes 3 resulting in a total of 2000 into your pension each year. In this example the employee chooses to keep their pension contribution of 1200 the same as it was without salary sacrifice.

A tax exemption exists for certain salary sacrifice arrangements. The example shows how a salary sacrifice arrangement might affect both you and an employee.

A Smarter Way To Make Pension Contributions Ppt Video Online Download

How Salary Sacrifice Works Youtube

Furloughing Staff Further Information And Examples Of How The Reclaim Is Calculated The Curtis Partnershipthe Curtis Partnership Chartered Certified Accountants In Cheadle Staffordshire

Https Quantumadvisory Co Uk Wp Content Uploads 2017 07 Salary Sacrifice Flyer A5 Final Pdf

Furloughing Staff Further Information And Examples Of How The Reclaim Is Calculated The Curtis Partnershipthe Curtis Partnership Chartered Certified Accountants In Cheadle Staffordshire

Salary Sacrifice Kent Ashford Maidstone Canterbury

The Lowdown On Salary Sacrifice Schemes And Tax

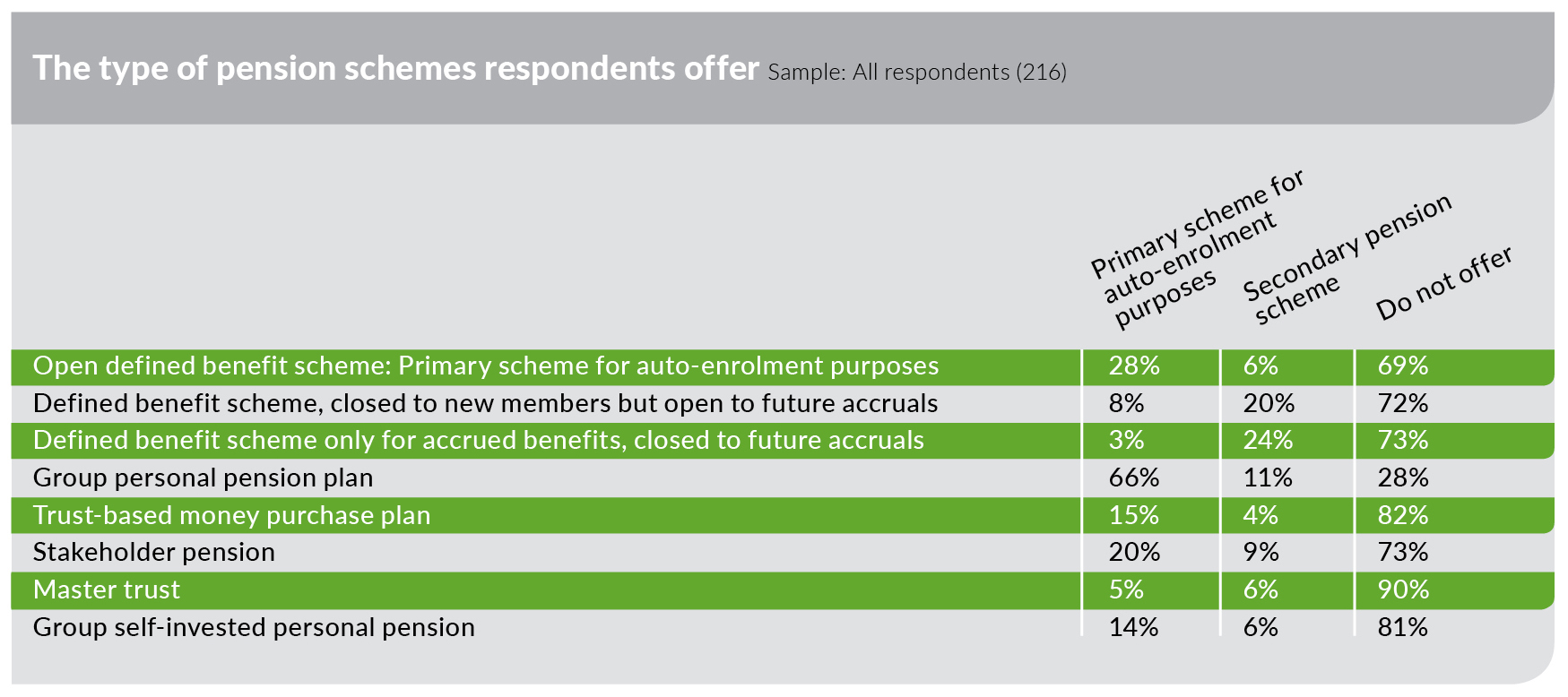

8 X 8 Group Personal Pension Plan Pension

Salary Sacrifice Savvy Financial Planning

Https Fleetworld Co Uk Wp Content Uploads 2017 11 Table Jpg

Exclusive 74 Offer Salary Sacrifice Pension Arrangements Employee Benefits

It May Be Time To Review Your Salary Sacrifice Arrangements Jackson Toms

How Employees Can Reduce National Insurance

Salary Sacrifice Pension Scheme

Salary Sacrifice And Auto Enrolment Edwards

Why Use Salary Or Bonus Sacrifice For Pension Funding Savvy Financial Planning

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

What Is Pension Salary Sacrifice And Why S It Under Threat Accountingweb

Post a Comment for "Salary Sacrifice Pension Example"